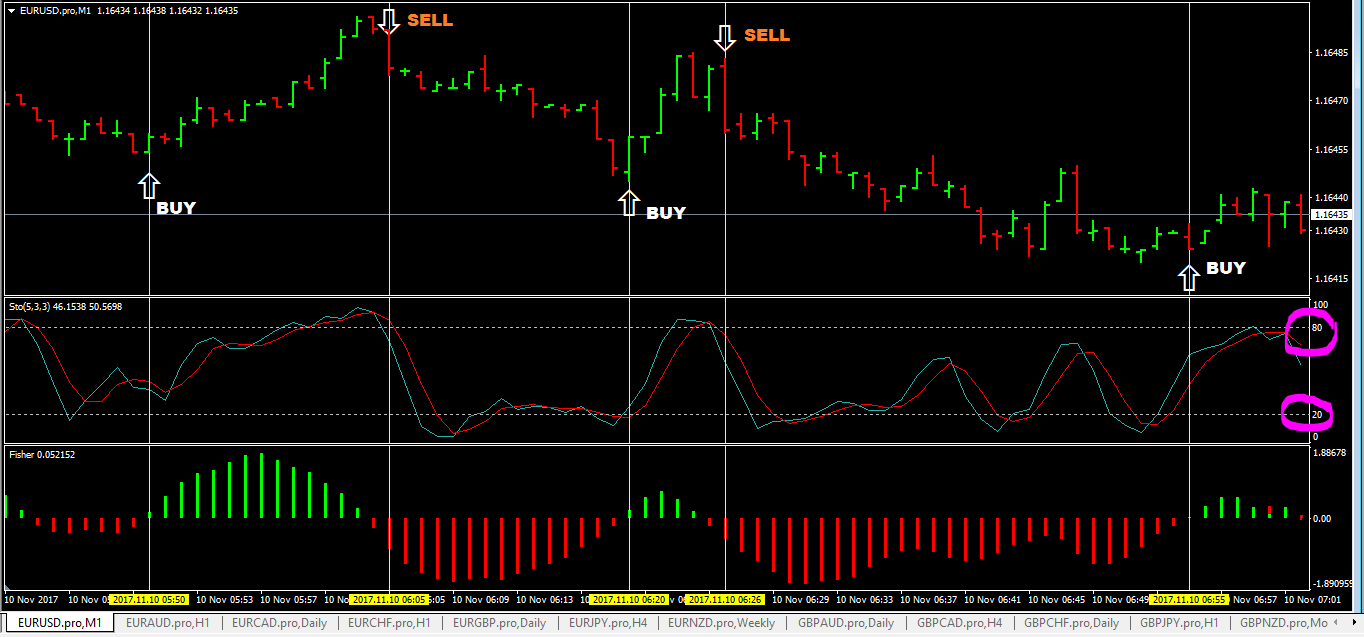

If the stochastic lines are below the 20 level, the price is deemed to be oversold and one should expect the price to start moving up.

The 1 minute forex scalping strategy with stochastic fisher indicator as the name says is made up of two indicators: stochastic and the fisher indicator.

We will breakdown the indicator, and you will be able to create for yourself the best stochastic settings for a 1-minute chart

The stochastic indicator is simply an oscillator that oscillates up and down between 0 and 100. If the stochastic lines are above the 80 level, the price is deemed to be overbought and there is potential for the price to move down.

The Fisher indicator is a quite simple histogram indicator that detects, direction and strength of the trend and signals trend changes.

1 Minute Forex Scalping Parameters

- The stochastic indicator (default settings)

- The fisher indicator (default settings)

- Currency Pairs To Trade: Low-spread currency pairs like EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD

- Timeframes: 1 minute or even 5 minutes or you can use it on higher timeframes as well.

1 Minute Forex Scalping – Buying Rules

The buying and selling rules are really simple. Refer to the chart below for the rules to follow. Let us start with the buying rules first:

- Fisher Indicator must have a green bar

- The stochastic indicator must go below the 20 level and the two stochastic lines have crossed over

- Place a buy market order or place a pending buy stop order 1 pip, above the high of the candlestick when it closes.

- Place your stop loss at the nearest swing low or the 10 pips below the entry price.

- For take-profit, aim for 1:3 risk to reward. For example, if you stop loss is 10 pips then aim for a 30 pips profit target.

1 Minute Forex Scalping – Selling Rules

- The Fisher Indicator must have a red bar

- The stochastic indicator must go above 80 level and the two stochastic lines have crossed over and are starting to go down.

- Place a sell market order or place a pending sell stop order 1 pip below the low of the candlestick when it closes.

- Place your stop loss at the nearest swing high, or at 10 pips above the entry price.

- For take-profit, aim for 1:3 risk to reward. For example, if you stop loss is 5 pips then aim for a 15 pips profit target.

Other Forex Scalping Strategies & Resources

- Bollinger bands indicator 5-minute forex scalping strategy

- 20 pips gbpjpy forex scalping strategy

- simple gbpusd eurusd forex scalping strategy

- 1 minute forex scalping strategy with trendlines and pin bars

- forex price action trading course

- forex swing trading course

- forex multiple timeframe trading course