The 20 pips a day forex trading strategy is somewhat similar to these two forex strategies:

- 10 pips a day forex trading strategy – you aim to make 10 pips a day with this trading system.

- 50 pips a day forex trading strategy – you are aiming to make 50 pips a day

In case you may be interested: Check out my free forex trading signals and trade setups based on price action. (Click that link)

The Idea Behind The 20 Pips A Day Trading Strategy

The main idea behind the 20 pips a day forex trading strategy is really simple:

- There are currency pairs that travel 100-150 pips in a day. So why no try to get a small portion of that daily move? Instead of trying to get 50 pips or 100 pips profit daily, which can be quite hard to get.

- It is much easier to make 20 pips profit, than a 100 or 150 pips profit.

- In order to do that, you have to trade the breakout of the previous day’s candlestick’s low or high. So when price breaks the prior day’s candlestick’s low, you take a sell trade. If price breaks the high, then you take a buy trade.

- And you only aim for 20 pips profit.

So that’s the basic idea of the 20 pips a day forex trading strategy.

Which Currency Pairs Can Be Traded with the 20 Pips A Day Trading Strategy?

Any currency pair offered at a broker like Pepper can be traded with this strategy. Even if you are only trading the major forex pairs, that still ok.

What Are The Suitable Timeframes?

For this system, it is suggested that you use the daily timeframe.

Any Forex Indicators Required?

No, you don’t need any forex indicators with the 20 pips a day forex trading strategy.

Forex Trading Sessions To Avoid

Forex trading happens 24 hours a day, and follows the sun around the globe. Having said that, the forex trading volume is lower or higher based on what part of the world is awake and trading it.

The London forex trading session and the New York trading sessions are the best forex trading sessions to trade using this system. But you should avoid trading during the Asian forex trading session.

Why? There is not sufficient trading volume to accelerate price movement either up or down. That’s why.

So what this really means is this: If the low or the high of the prior day’s candlestick was broken during the Asian session then do not trade that setup.

Example of A Buy Trade Setup

The chart below is a daily chart of USDCAD. Here are the buy rules of how you can trade the 20 pips a day forex trading strategy:

- First thing you do is open up your chart and place two opposite pending orders; a buy stop pending order 1-2 pips above the high of the daily candlestick and a sell stop pending order 1-2 pips below the low.

- Set your stop loss at 20 pips

- Set your take profit target at 20 pips.

- If the high or low of the daily candlestick was already broken during the Asian trading session, do not trade. What you want to see is to see the breakout of the low or high of the daily candlestick happen during the London or the New York Forex Trading Sessions.

- If one pending order is activated, you must immediately cancel the other. In this case below, the high was broken so the sell stop pending order should be cancelled.

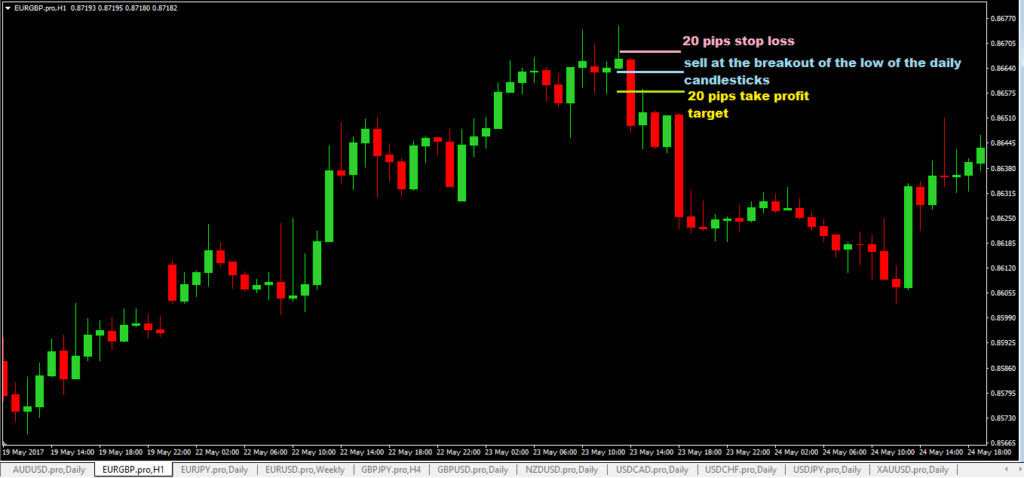

Example of A Sell Trade Setup

The chart below shows an example of a sell trade setup based on the 20 pips a day forex trading strategy. The trading rules are the same as given above but for this case, notice that the low of the daily candlestick was broken so the pending sell stop order would have been activated.

Which means the pending buy stop order must be cancelled when that happens.

Advantages of the 20 Pips A Day Forex Trading Strategy

- really simple price action forex trading strategy.

- you can just trade once currency pair daily, just aiming for 20 pips profit.

Disadvantages of the 20 Pips A Day Forex Trading Strategy

- risk reward ratio of 1:1 is not good. this means that if you lose 10 times in a row, you really need 10 winning trades in a row to recover your trading loses or have a more wins than loses to recover your loses.

- 20 pips stop loss placed on a daily candlestick can be hit easily.