The ascending triangle chart pattern forex trading strategy is the complete opposite of the descending triangle chart pattern forex trading strategy.

An ascending triangle chart pattern is considered a bullish chart pattern and it can form during an uptrend as a continuation pattern or it can form in a downtrend and after that pattern has formed, trend can change to an uptrend.

How does The Ascending Triangle Chart Pattern Form?

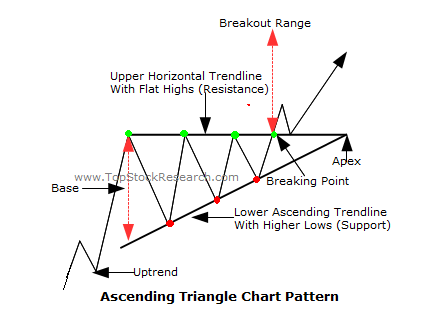

The following chart from topstockresearch.com really gives good clarity on how the ascending triangle chart patterns form:

As you can see on the chart above:

- price is temporarily restricted from moving higher by the resistance level.

- but on the other hand, the price continues to make higher lows until a breakout happens and price shoots up.

How To Trade The Ascending Triangle Chart Pattern-The Trading Rules

- Once you’ve identified that an ascending triangle chart pattern is forming, you need to wait for the breakout to happen to the upside. The candlestick that breaks out the resistance and closes above the resistance level is called the breakout candlestick.

- Place a buy stop pending order 2 pips above the high of the breakout candlestick.

- place your stop loss 5-10 pips below the low of the breakout candlestick, or if you are thinking of the tighter stop loss, place is on the mid level of the breakout candlestick.

- you can calculate your take profit based on risk:reward of 1:3 or you can look for a previous swing high and use that peak as your your take profit target level.

Advantages of The Ascending Triangle Chart Pattern Forex Trading Strategy

- this chart pattern trends create some explosive price moves to the upside so if you can get into a buy trade using the rules above, you can make a lot of pips.

- this pattern can from in any timeframe from the one minute up to the monthly timeframe.

Disadvantages Of The Ascending Triangle Chart Pattern Forex Trading Strategy

- If the breakout candlestick is too long, this can result in your stop loss distance being quite big.

- Sometimes, false breakouts will happen making you think that the price is going to go up but only to reverse and knock out your stop loss