The daily pin bar forex trading strategy is price action trading strategy that is based on the daily chart but trade entries are based on 1 hr timeframe or even the 4hr timeframe.

In other words, you are using a trading technique called multiple timeframe trading or in short, multi-timeframe trading.

The purpose of using smaller timeframe for you trade entries is for having tight stop loss.

Currency Pairs To Trade?

You can trade any currency pair with this trading system.

Timeframes To Trade?

Daily and 1 Hr Timeframes.

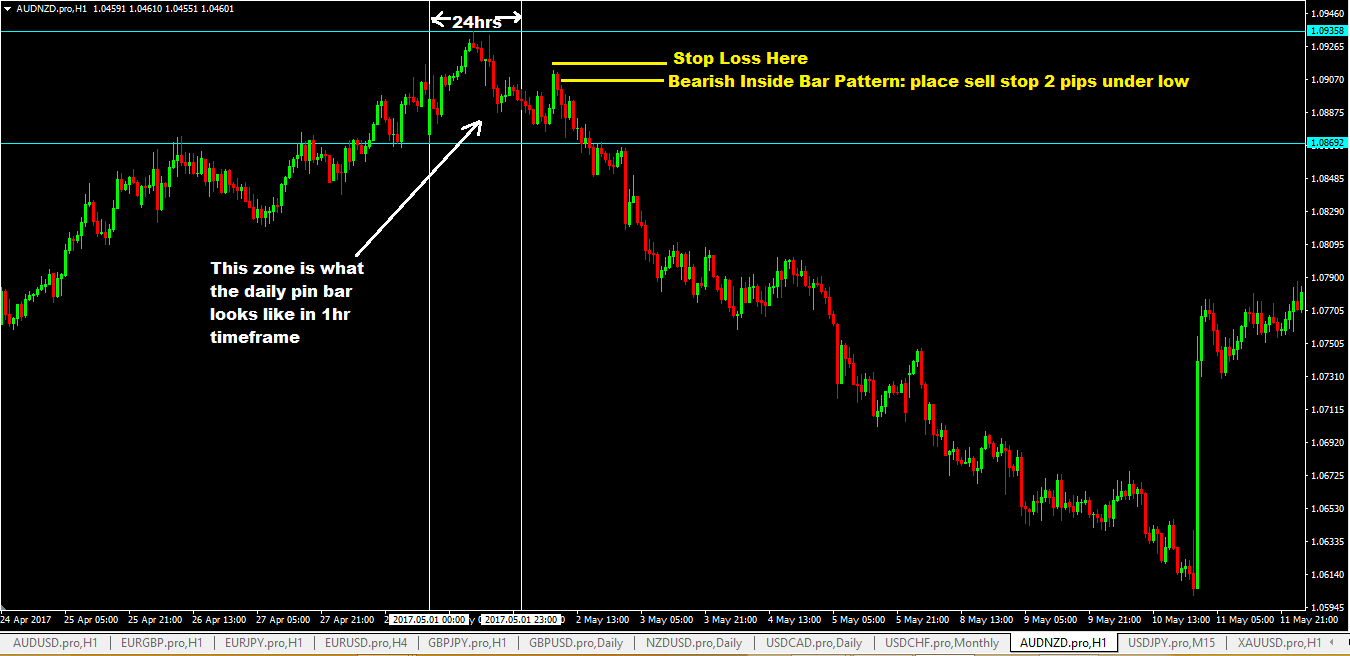

The daily timeframe is for identification of the pin bar and the 1hr timeframe is for trade entries…that’s where you look for bearish and bullish reversal candlestick patterns to sell or buy respectively.

Need Forex Indicators?

No, you don’t need to use any forex indicator for this. This is just 100% price action trading.

Daily Pin Bar Forex Trading Strategy Rules

- first you need to monitor the daily chart, at the close of each day to see if a pin bar has formed

- when a pin bar forms on the daily chart, the next thing you do is switch down the 1hr timeframe to look for a buy or a sell signal.

- If the main trend is down and a bearish pin bar forms on the daily chart, you look have to wait for the candlesticks in the 1hr to start going up (opposite to the main trend) and as they are going up, look for signs of weakness. What you will see is that bearish reversal candlestick patterns forming. These would be the signal you need to place your pending sell stop order 2 pips under the low and wait for price to come down and activate it. If price keeps going up, you cancel that pending order and keep monitoring and repeat the same process if you see bearish reversal candlestick patterns.

- If the main trend is up and you see a bullish pin bar form, you do the exact opposite of the sell trade setup: look for bullish reversal candlestick patterns in the 1hr timeframe that form as price is heading away and opposite to the main trend in the daily timeframe.

Another Trade Entry Technique

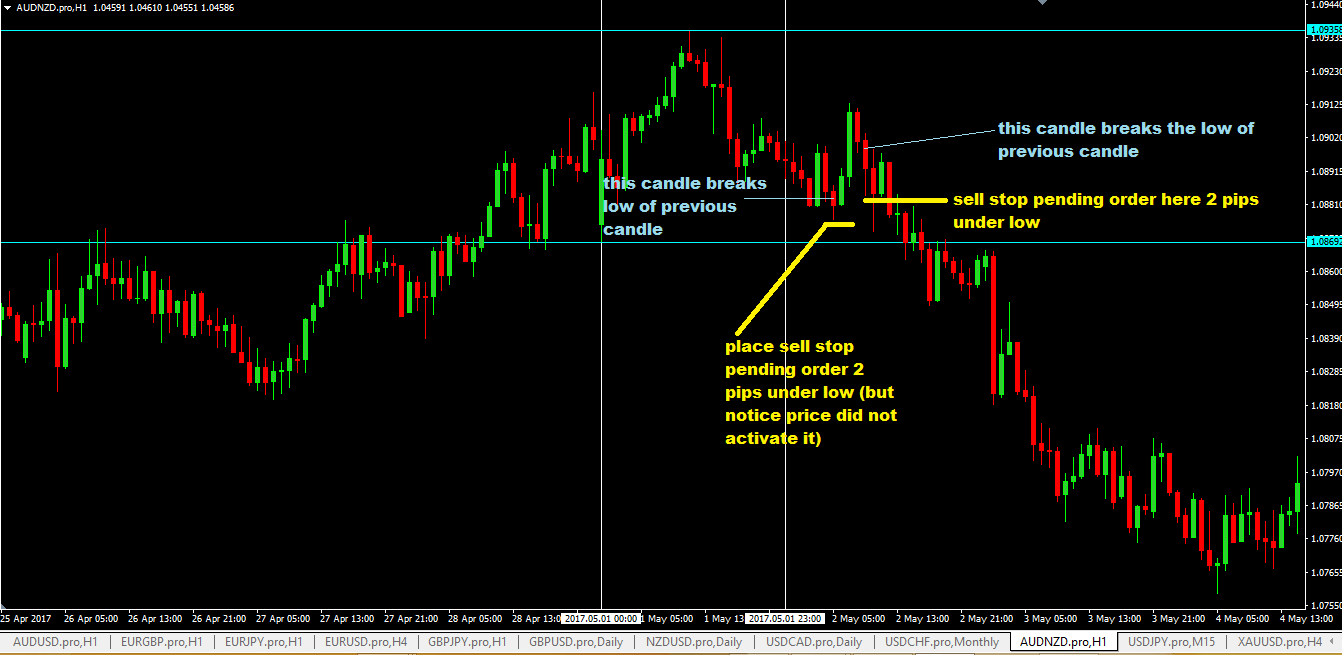

Another way to trade the daily pin bar would be to wait for the 1hr candlestick to break the high or the low of the previous candlestick and place a pending buy stop and sell stop order respectively as soon as that candlestick that does the high/low breaks is formed.

The chart below is the same chart as above with an explanation:

Advantages of The Daily Pin Bar Forex Trading Strategy

- you trade with the trend and if your trade goes as anticiapted, the gains (profits) can really start to build up quickly.

- tight stop loss, which means you can increase your contract sizes without necessarily increasing risk which you can’t do if you traded the breakout of the daily pin bar itself.

- pin bars show a sudden change in sentiment and the breakout of the high/low tends to keep prices moving in the main trend for a lot longer time which means if you ride out the trend using trailing stop loss, you can potentially make more gains in profits.

Disadvantages of the Daily Pin Bar Forex Trading Strategy

- daily pin bars can form anywhere on the chart but not all pin bars have significance so you should learn to pick which daily pin bars are worth trading. The pin bars worth trading are those that form on major support and resistance levels including fibonacci levels like 61.8