The Outside Bar Forex Trading Strategy is somewhat similar to the inside bar forex trading strategy but this time the inside bar forms first, then the outside bar forms later.

Now, if you don’t know what an outside bar is, then here is a bit of an explanation.

So What Is An Outside Bar Pattern?

The outside bar is the bar (candlestick) whose high and low engulfs the high and low of the previous candlestick. Which means that the previous candlestick lies within the shadow of this outside bar.

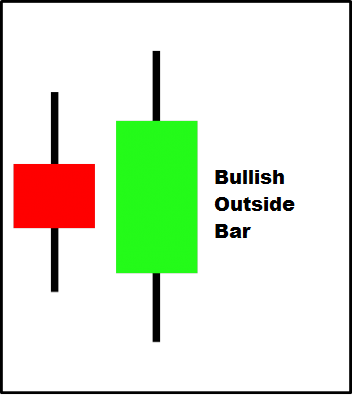

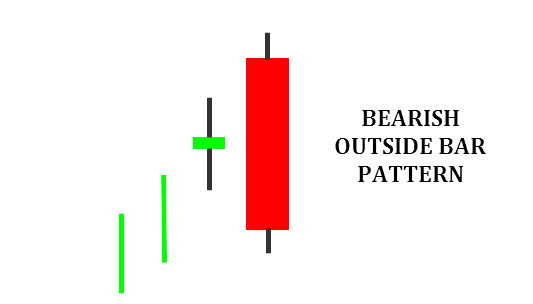

Here’ are examples of what a bullish and bearish outside bar patterns looks like…

This one is a text book example of a bullish outside bar pattern:

- the first candlestick is bearish (red colour) and is short in comparison to the second bullish candlestick, which is the outside bar.

This one below is again, a tex book example of a bearish outside bar pattern.

So now that you know what an outside bar pattern looks like.

What Are The Best Timeframes To Trade The Outside Bar Trading Strategy?

4 hr and daily timeframes are recommended but you can also use it on 1 hr timeframe if you prefer to.

What Currency Pairs To Trade?

You can trade any currency pair.

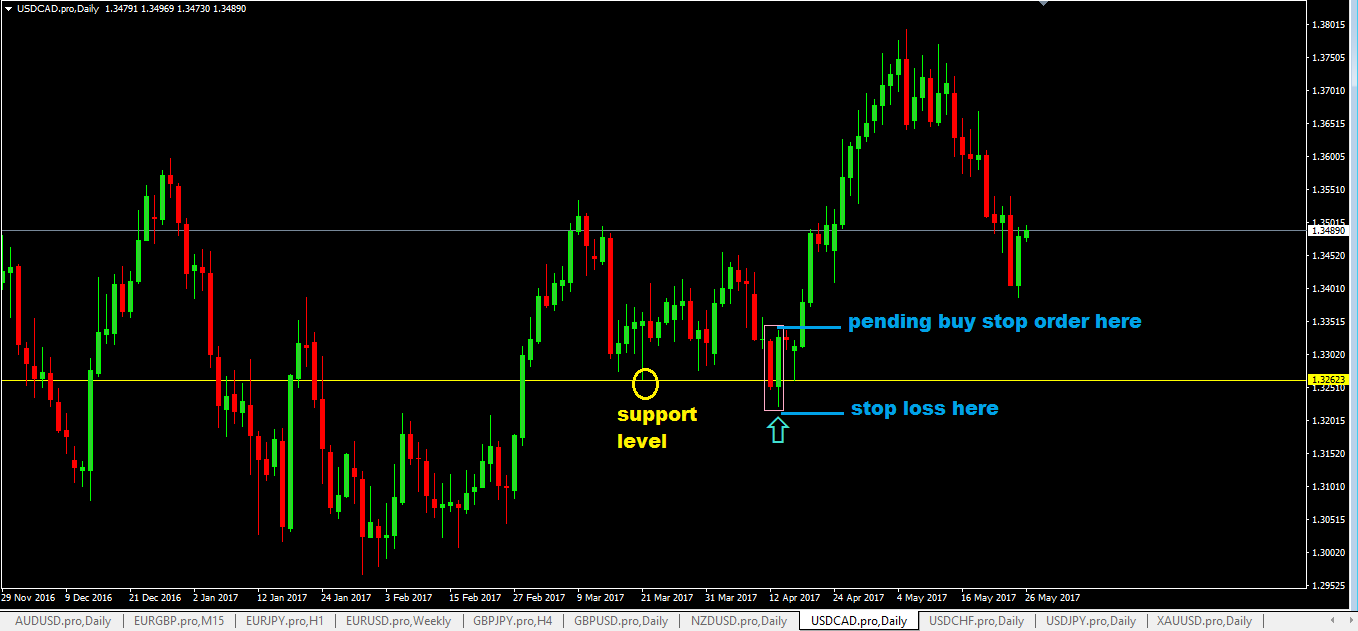

Example of A Bullish Outside Bar Trading Setup

This chart below is the daily chart of USDCAD. Here are a few things to note:

- price has been trending up and made found support at around the 1.3262 level shown by the yellow line.

- price went up and then came back down to test the support level and the you can see the price action has formed a bullish outside bar pattern on the support level…this was a good buy signal.

- after that, the market just want up.

So the trading rules are really simple:

- identify levels of support where a bullish outside bar pattern can form.

- place your pending buy stop order 1-2 pips above the high of the outside pattern.

- place your stop loss 5-10 pips below the low of the outside bar pattern.

- for take profit targets, aim from previous swing high point or peaks or you can aim for a risk:reward of 1:3

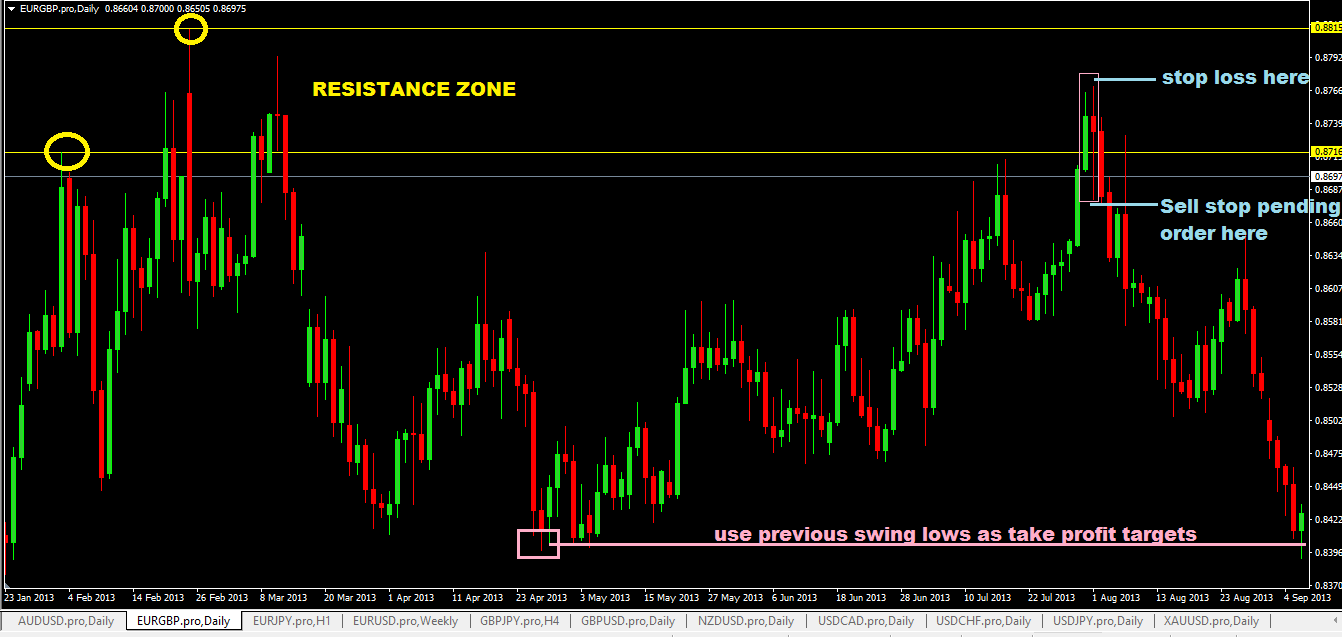

Example of A Bearish Outside Bar Trading Setup

This below is a daily chart of EURGBP. Here are a few things to note:

- price has been heading up for a while until it hit a “resistance zone” as seen on the chart below.

- as you can see, price formed a bearish outside bar pattern in the resistance zone.

- after that price continued to move down further.

What are the trading rules for a sell setup then? Well, just the exact opposite of a buy setup:

- identify resistance levels on your charts where you can watch for the bearish outside bar pattern to form.

- then place your sell stop pending order 1-2 pips below the low of the outside bar pattern.

- place your stop loss 5-10 pips above the high of the outside bar pattern.

- identify previous swing lows and use those levels as your take profit target levels or use risk:reward of 1:3

Advantages of the Outside Bar Forex Trading Strategy

- Outside bar patterns are strong reversal patterns when they do form around significant levels such as support and resistance levels.

- Good risk to reward ratio.

- An easy trading system to understand and implement.

Disadvantages of the Outside Bar Forex Trading Strategy

- I tend to see a lot more inside bar patterns compared to an outside bar pattern in forex on the daily chart which means that you may not see many outside bar patterns setups form if you only monitor a handful of currency pairs to trade.

- The stop loss distance can be huge if the outside bar itself is long, therefore, reduce your contract size to manage or keep your risk to an acceptable level.