The pin bar forex trading strategy is a price action trading system that uses the pin bar for trade entries.

Pin bars show a drastic change in market sentiment. In an uptrend, if you see a bearish pin bar form in a resistance level, it can be a good signal that the a downtrend may be forming.

Similarly but on the opposite, if you see a bullish pin bar form in a downtrend in a support level, there’s a possibility that an uptrend may be forming.

Currency Pairs To Trade?

You can use the pin bar forex trading strategy to trade any currency pairs.

Timeframes To Trade?

You can trade with any timeframe but I suggest you trade with 1 hr timeframe and upwards, those larger timeframes…they tend to be more reliable and there is less noise.

Forex Indicators Required?

You don’t need any forex indicator.

Here’s What A Pin Bar Looks Like

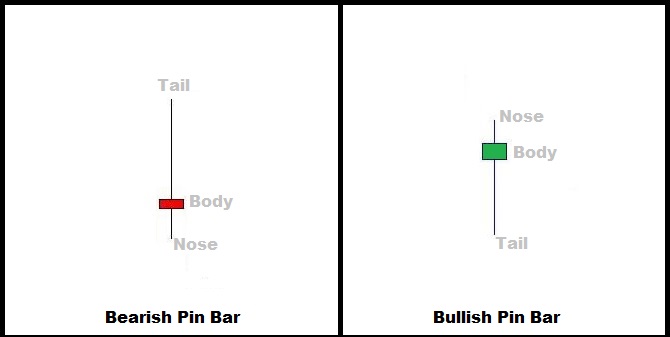

If you are totally new to forex trading, you wouldn’t have a clue as to what a pin bar looks like so here is a chart of what bearish and pullish pin bars look like.

Here are a few things to note:

- A pin bar pattern is a one candlestick pattern

- a very distinct feature of pin bars is their very long tails and a tiny body.

- nose of pin bars should be little to no nose at all.

How To Trade The Pin Bar Forex Trading Strategy

Trading pin bars should come easy to you if you can identify level like:

- support and resistance levels.

- fibonacci retracment levels.

- where price comes and hits trendlines or channel trendlines.

Here’s how to trade Bearish Pin Bars:

- in an uptrend, if price hits an resistance level or a downward trendline, wait to see if you see a bearish pin bar.

- place a pending sell stop order 2 pips below the low of that bearish pin bar.

- then place your stop loss 5-10 pips above the high of the bearish pin bar.

- use previous swing lows as take profit target levels.

Here’s How To Trade Bullish Pin Bars:

- in a downtrend, if price hits a support level or a rising trendline, wait to see if you see a bullish pin bar.

- place a buy stop order 2 pips above high of the bullish pin bar.

- place your stop loss 5-10 pips below the low of that bullish pin bar.

- use previous swing highs as your take profit target level.

Advantages Of Trading Pin Bars

- pin bars are an easily identifiable reversal candlestick patterns.

- they form in all timeframes presenting opportunities for the forex scalper as well as the swing trader.

- good risk:reward ratios for trades that work out as anticipated.

Disadvantages of Trading Pin Bars

- not all pin bars are created equal so avoid trading pin bars that form anywhere on the chart at levels that make no sense or are not support and resistance levels etc.

- I tend to agree with many other traders that trading pin bars in smaller timeframe will result in what’s called a “noise” in forex….

Don’t forget to share this pin bar forex trading strategy with your fans by clicking those sharing buttons below.