The support and resistance forex trading strategy is one of the most popular forex trading strategy that is used by thousands of traders all over the world.

Support and resistance levels trading forms the core of many forex trading strategies you will find on this forex trading website.

Trading support and resistance levels is really simple:

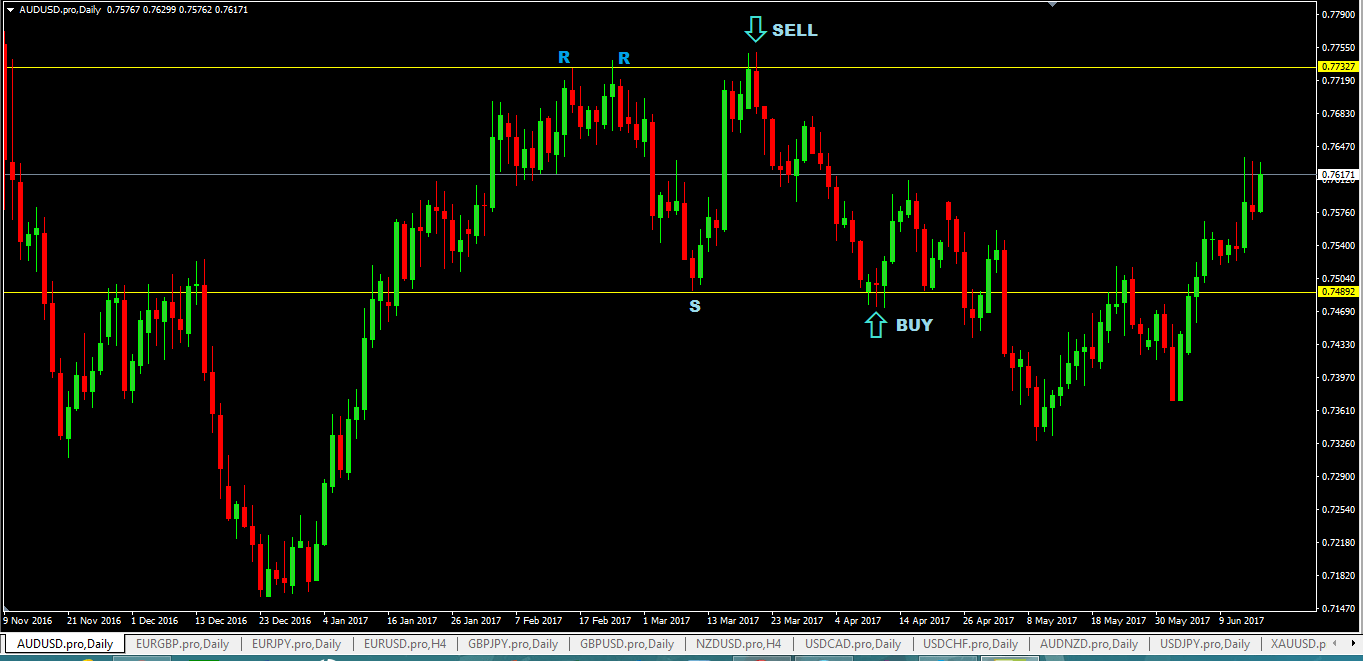

- identify resistance levels, and if price head up to that resistance level again, look for an opportunity to sell.

- identify support levels and if price heads down to those support levels, look for an opportunity to buy.

Currency Pairs To Trade?

You can use this trading system to trade any currency pair.

Timeframes To Trade

You can trade any timeframe but I suggest you use 15minute timeframe and above.

Any forex Indicators Required?

No forex indicators are required as this is a 100% price action trading system. All you need is the ability to identify support and resistance levels in whatever timeframe you are trading.

Support And Resistance Level Forex Trading Strategy Rules

Buying Rules:

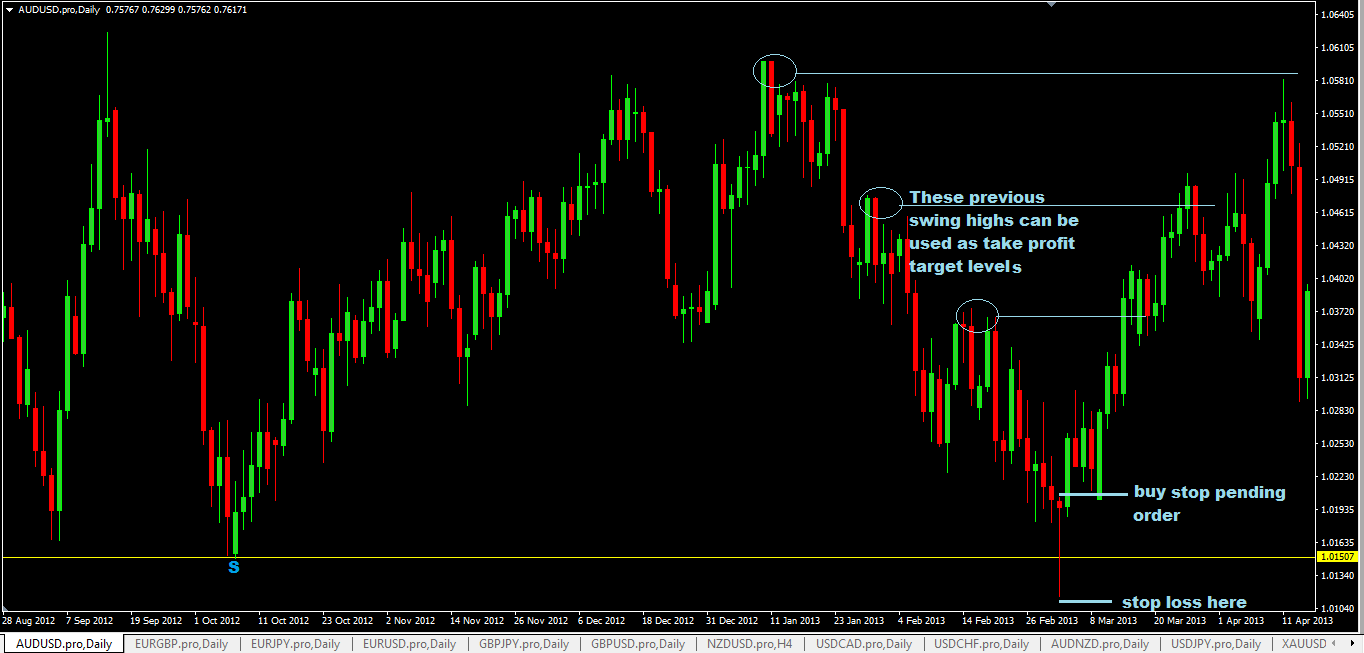

- once you have identified a support level and if you see price heading back down to it, wait for price to hit that level.

- after price hits that level, see if you can see a bullish reversal candlestick pattern.

- place a buy stop pending order 2 pips above high of that bullish reversal candlestick pattern.

- place your stop loss 5-10 pips below the low of that bullish reversal candlestick pattern.

- for take profit, you can use previous swing highs or calculate it based on risk:reward ratio of 1:3

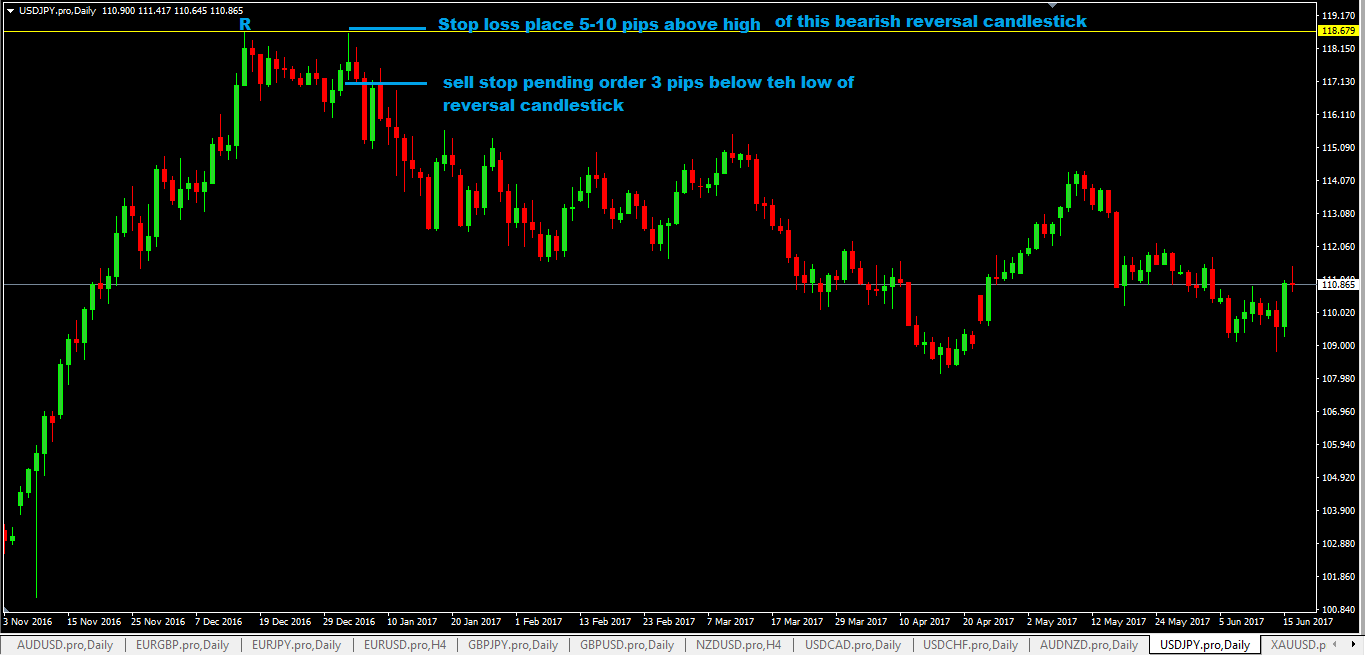

Selling Rules:

- identify your resistance level and see if price head back up to that resistance level.

- place a sell stop pending order 2 pips below the low of the bearish reversal candlestick pattern.

- place your stop loss 5-10 pips above the high of that bearish reversal candlestick pattern.

- for take profit, use previous swing lows or calculate it based on risk:reward ratio of 1:3

Advantages of The Support And Resistance Forex Trading Strategy

- this is one of the very few forex trading systems that have really excellent risk:reward ratio. You can get risk:reward of 1:10 and above and one well placed trade followed by a strong trend can increase your trading account 50% to 100% or more and it really depends on how long you can ride it as well as your take profit target(s).

- this forex trading system is based on solid trading fundamental of support and resistance levels and it is easy to predict with the help of reversal candlestick patterns where the market is most likely to head.

- really simple trading rules anyone can follow.

Disadvantages of the support and resistance level forex trading strategy

- support and resistance levels are not lines drawn in in concrete…they do get broken at some point down the line.

- support and resistance levels are not specific price levels, they need to be considered as zones because sometimes price will not really come down to the EXACT level as before and start to turn.

- new forex traders may have difficulty in identifying genuine support and resistance levels.

Don’t forget to share this support and resistance forex trading strategy if you’ve enjoyed it by clicking those sharing buttons below.