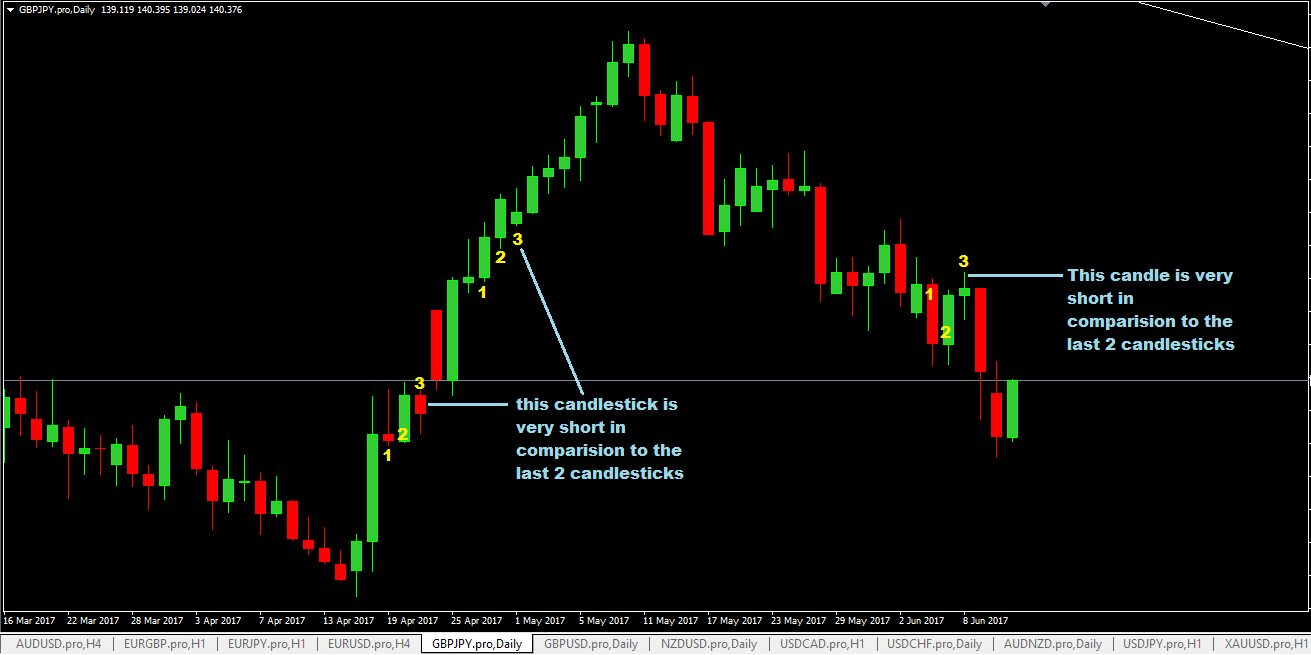

The third shortest candlestick forex trading strategy is a price action trading system that is based on analyzing the lengths of 3 candlesticks and the last candlestick in sequence which has the shortest length is the trigger candlestick where you place a pending buy stop or sell stop order under its high or low respectively.

The reason behind the trading system is this:

- when candlesticks have momentum, they tend to have full body and also longer in length.

- but when there is less momentum in price, candlestick bodies and lengths start to get shorter and this happens when price is consolidating. In this consolidating phase, its like it resting and gaining energy for its next move and the next move, price movement is usually explosive .

So what happens during the period where the candlesticks bodies and lengths start to get shorter?

Well, we can say that the price is consolidating and that tends to happen when either the buyers and sellers equal out or that’s when there’s not much trading activity going on as traders are just sitting on the sideline waiting to see how the price will go.

The chart below is a GBPJPY Daily chart and shows you and example of how to pick out the third shortest candlestick:

Currency Pairs To Trade?

You can trade any currency pairs with the third shortest candlestick forex trading strategy.

Timeframes Required?

I suggest you use only the daily or the 4hr timeframes when using this forex trading system.

Any Forex Indicators Required?

No forex indicators are required for this trading system.

Rules of The Third Shortest Candlestick Forex Trading Strategy

- Pick a timeframe, like the daily or the 4hr and wait for the current candlestick to close.

- As soon as that current candlestick closes, compare its length with that of the two previous candlesticks and see if its length is unusually short.

- If the length is much shorter in comparison to the other two, then place a pending buys stop order 2 pips above its high and also a pending sell stop order 2 pips below its low.

- Also place your stop loss on each side of the high/low of the candlestick at least 2-5 pips or increase it a little bit more if the currency pair has a huge spread.

- As soon as on of the pending order is activated, you must cancel the other pending order that is not activated.

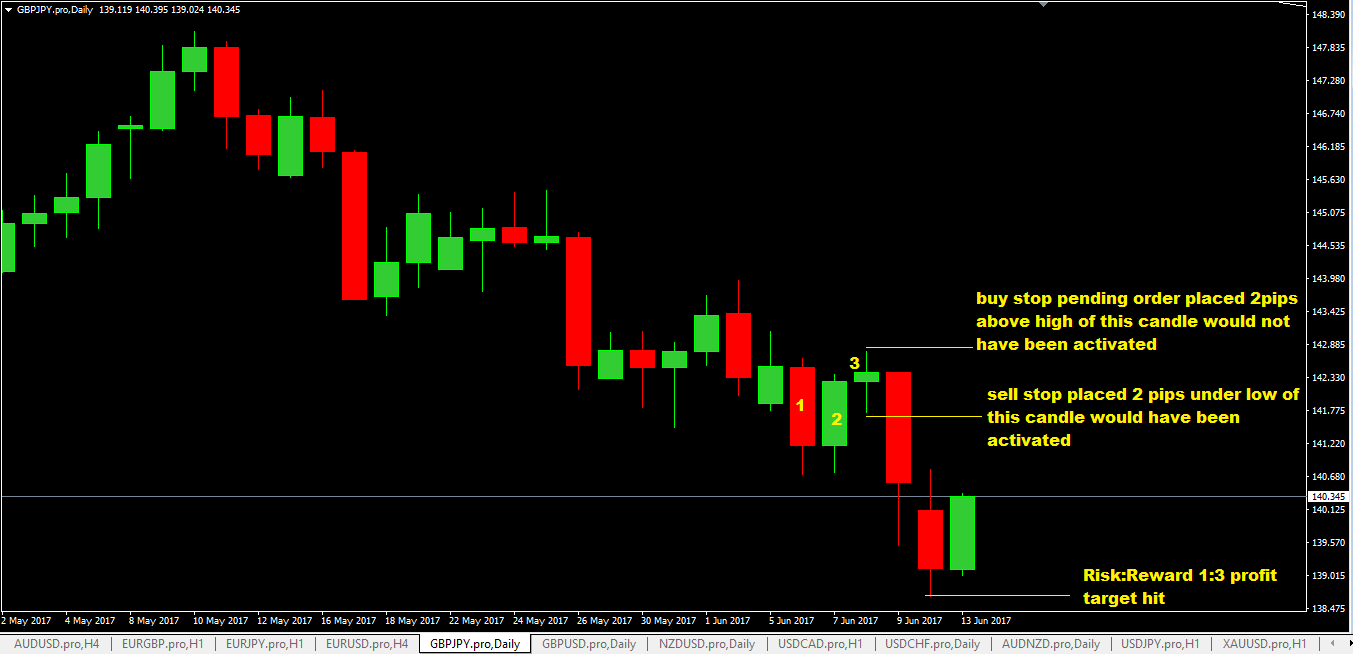

- For profit targets, you can use previous swing high/swing low points are your targets for your profit or aim for a risk reward of 1:3 or you can use trailing stop to see if you can ride out the move/trend until you get stopped out eventually.

Here’s A Trade Setup Example Of the Third Shortest Candlestick Forex Trading Strategy

The chart below shows you how to take trade setups based on this trading system. Whenever you find a candlestick that is much shorter than the previous 2 candlestick, all you do is place to opposite pending orders on both sides of the high and low of the candlestick.

Another Way to Trade This System Is This

The rules given above are based on placing pending orders on both sides of the high and low of the third shortest candlestick REGARDLESS of the main trend in that timeframe.

What is you only want to place a pending order in the direction of the main trend?

Well, you can!

So lets say that on the GBPJPY trade above, we can see that the trend is down.

So what does that mean?

That means you only need to place a pending sell stop order because the trend is down and there’s a great chance that price will break the low of the third shortest candlestick and continue to head down.

Similarly, if the trend is up, you only need to place a pending buys stop order.

This is another way to trade this system.

Advantages of The Third Shortest Candlestick Forex Trading Strategy

- it is a really easy forex trading system to understand and implement.

- it can be a set and forget trading system for those that have day jobs and who can monitor their trading screens regularly.

- good risk to reward ratio especially if the third shortest candlestick is very short and you can aim for a lot more profit that the 1:3 risk to reward.

- when a candlestick is very short, it means price is consolidating withing a very tight range which you will see if you switch down to a much smaller timeframe. What this also means is that it is like a coiled spring that is pushed down and isn’t released yet. Explosive price moves tend to happen after a breakout of the low or the high happens and using this trading system allows you to capture that explosive price move.

Disadvantages of The Third Shortest Candlestick Forex Trading Strategy

- sometimes, price spikes do happen triggering a pending order as if to go in the direction of the order only to reverse and go the other way…such is the nature of forex trading so be prepared for it because it happens.

If you’ve enjoyed this, please don’t forget to share by clicking those sharing buttons below. Thanks