The three black crows chart pattern forex trading strategy is based on a specific chart pattern called the three black crows chart pattern.

In here you will learn what a 3 black crows chart pattern is and some techniques on how to trade the three black crows chart pattern.

What Is The Three Black Crows Chart Pattern?

The three black crows chart pattern is a bearish reversal chart pattern.

It consists of 3 consecutive bearish candlesticks that have the following characteristics:

- each candlestick closes lower than the one before which means that the bears are aggressively driving prices down

- the second and the third candlesticks open within the body of the candlesticks preceding them. (Now, in forex, which is the most liquid market in the world, it would be really rare for you to see this situation so we can make an exception here and ignore this condition)

- ideally, each candlestick should have no lower shadow at all, which indicates that the bears are able to keep prices down at just around the low of that particular period or timeframe.

- all 3 candlesticks should have bodies of approximately the same size

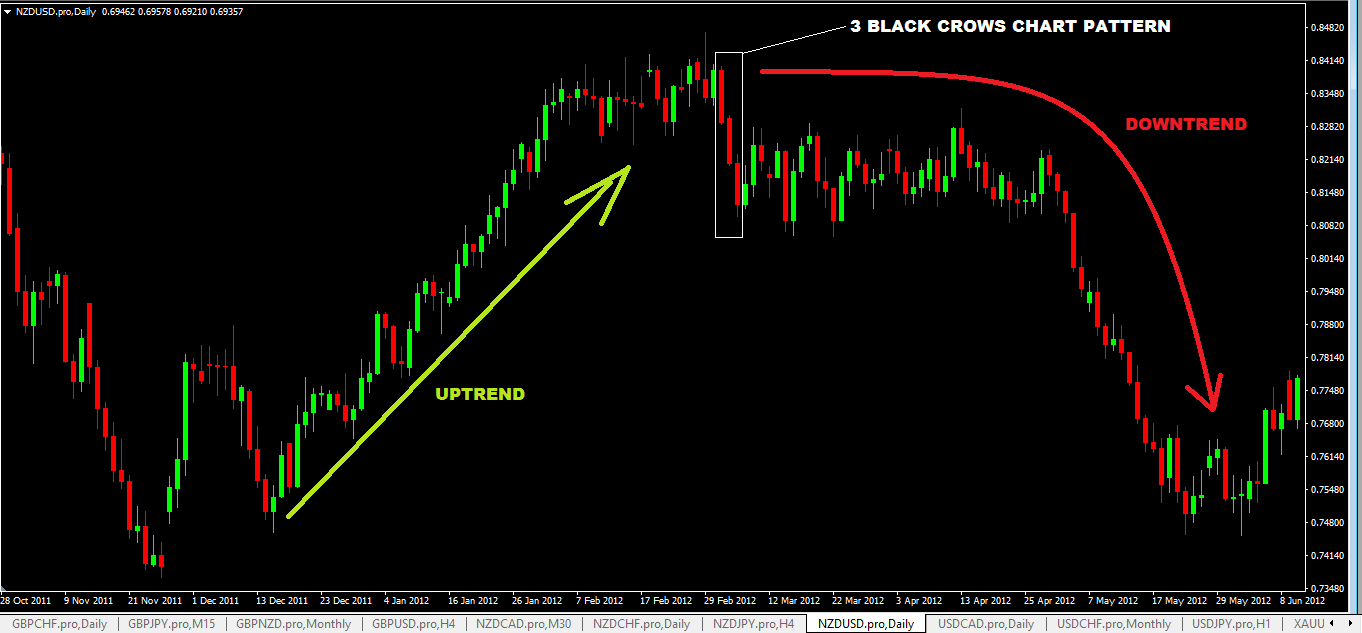

This NZDUSD daily chart below, you can see an example of a 3 black crows chart pattern:

- Note that market has been an uptrend.

- 3 black crows chart pattern forms indicating a strong selling action by the bears and after that price moved up temporarily but then that upward movement failed and market moves down into a downtrend.

Trading Parameters And Requirements

Currency Pairs: Any

Timeframes: Any

Forex Indicators: none required

Trading Sessions: Any but preferably the London and New York Forex Trading Sessions

Selling Rules

This is a bearish pattern so there is only selling rules here:

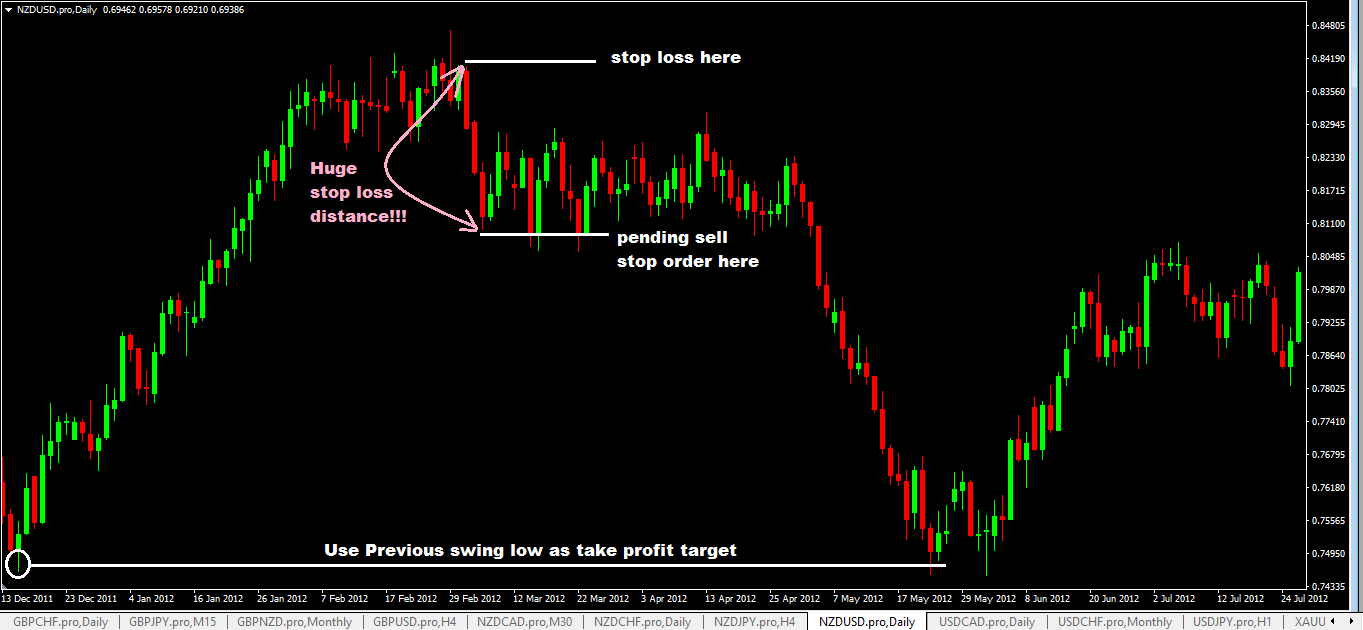

- Place a pending sell stop order 1-2 pips below the low of the 3rd candlestick

- place your stop loss order 1-2 pips above the high of the first candlestick

- for take profit, you can use 1:3 risk to reward ratio to calculate your profit target or use a previous swing low point to take profit once price reaches that level as long as you have a positive risk:reward ratio.

Another Way To Trade The Three Black Crows (Sell On Rallies)

In my opinion, I would not like to trade the three black crows chart pattern based on the rules given above.

Why?

There are 3 things I don’t like:

- the stop loss distance is huge

- if the stop loss distance is huge, it has a direct impact on my risk:reward ratio.

- the selling may have been overstretched and by the time you place your sell order, price may not directly continue to go down but start heading up!

So that million dollar question is: is there any other way this chart pattern can be traded without a large stop loss distance?

Answer: yes.

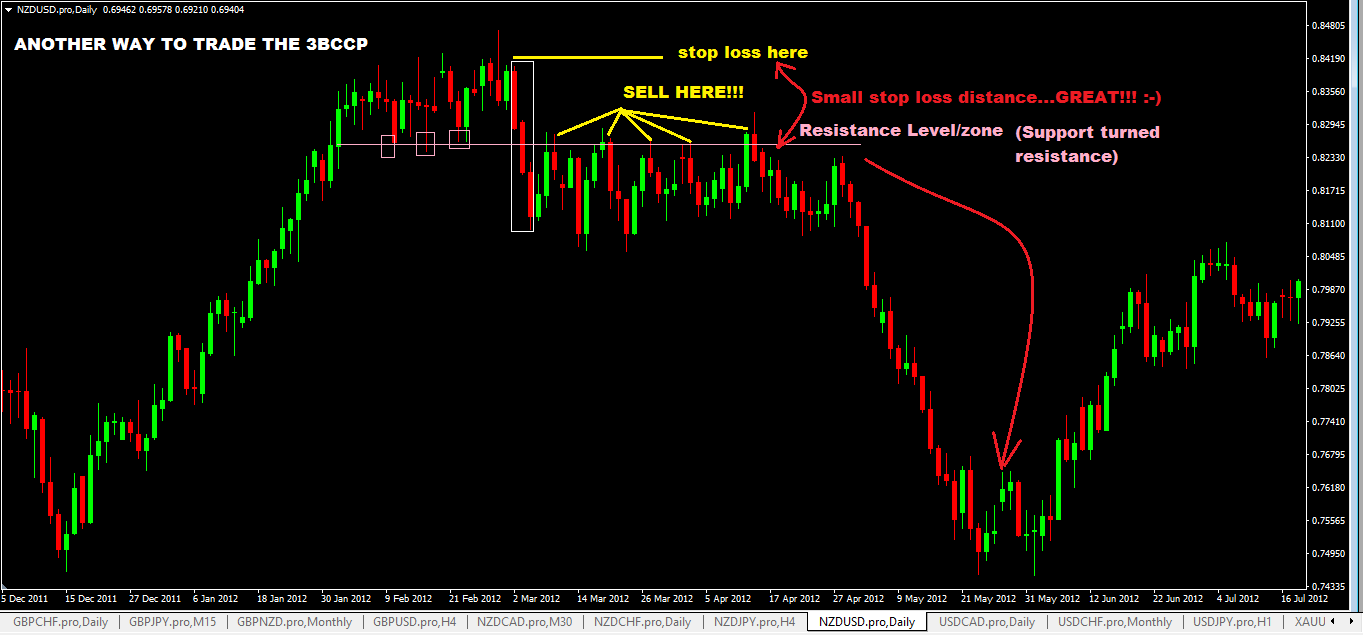

How? Sell on any rallies made upward after the formation of the 3 black crows chart pattern.

In order to do that,you look for things like:

- support turned resistance levels,

- fib retracement levels like 38.2 or 68.1

- and confirm your sell signal with bearish forex reversal candlestick patterns and go short.

The chart below is the same chart given above but shows you the better way to trade this pattern:

Disadvantages of The 3 Black Crows Chart Pattern Forex Trading Strategy

- as mentioned above, selling wold have been overstretched by the bears and after that there is the likelihood that price may make a rally upward after that. Where the rally is temporary (which means it fails and price later falls down) is left to be seen.

- stop loss distances tend to be humongous if you are trading off the daily and the 4hr char and even the 1 hr chart.

- if the stop loss distances are huge, this would have a direct impact on your risk:reward ratio.

Advantages Of The 3 Black Crows Chart Pattern Forex Trading Strategy

- Selling on temporary rally (or rallies) can give you really good risk:reward ratio should your trade works out as anticipated.

- if your trading setups are based on larger timeframes and you are willing to keep your trades running for days, you can make 100’s pips plus in profits with just one trade.

Other Trading Resources on This Site You May Be Interested In

- Free Forex Price Action Trading Course

- Free Forex Swing Trading Course

- Free Multiple Timeframe Trading Course

- Free Price Action Forex Trading Signals (Provided Weekly)

Don’t forget to click those sharing buttons below share, like etc.