The 123 Chart Pattern Forex Trading Strategy is a price action trading strategy based on the 123 chart pattern.

The 123 chart pattern can be used in both the uptrend and downtrend market.

The 123 Pattern

How does a 123 pattern form in a downtrend and uptrend market?

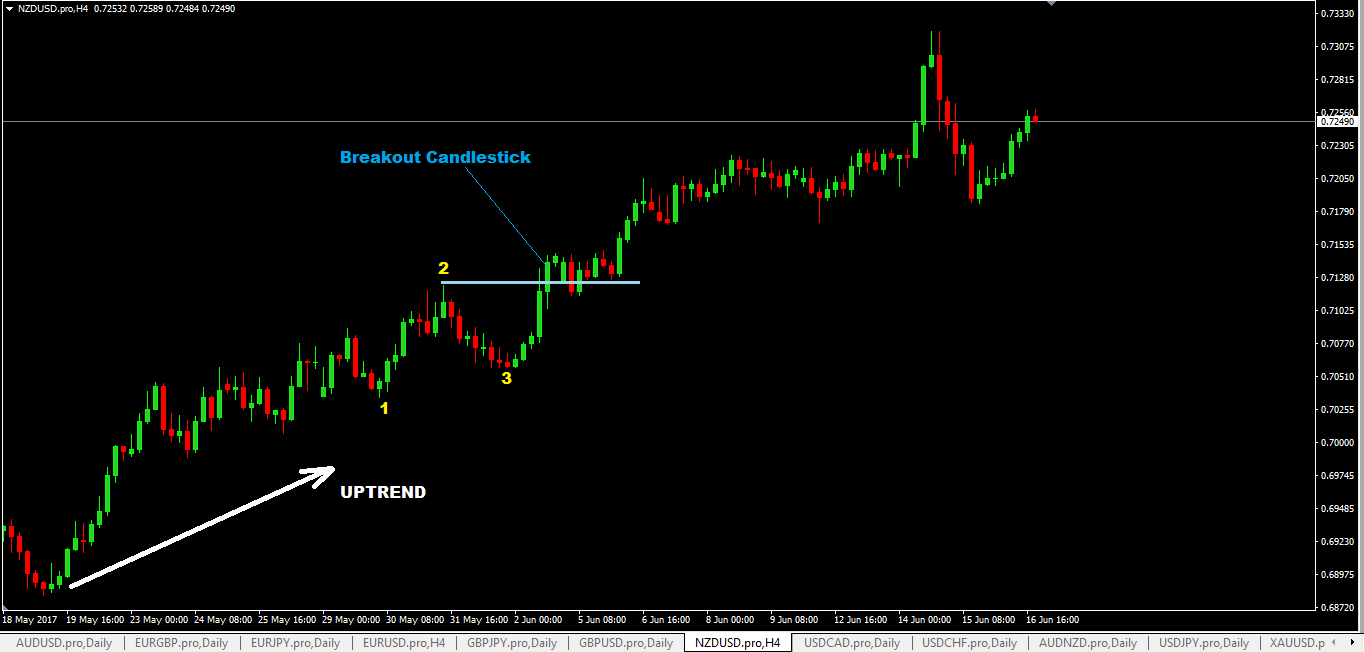

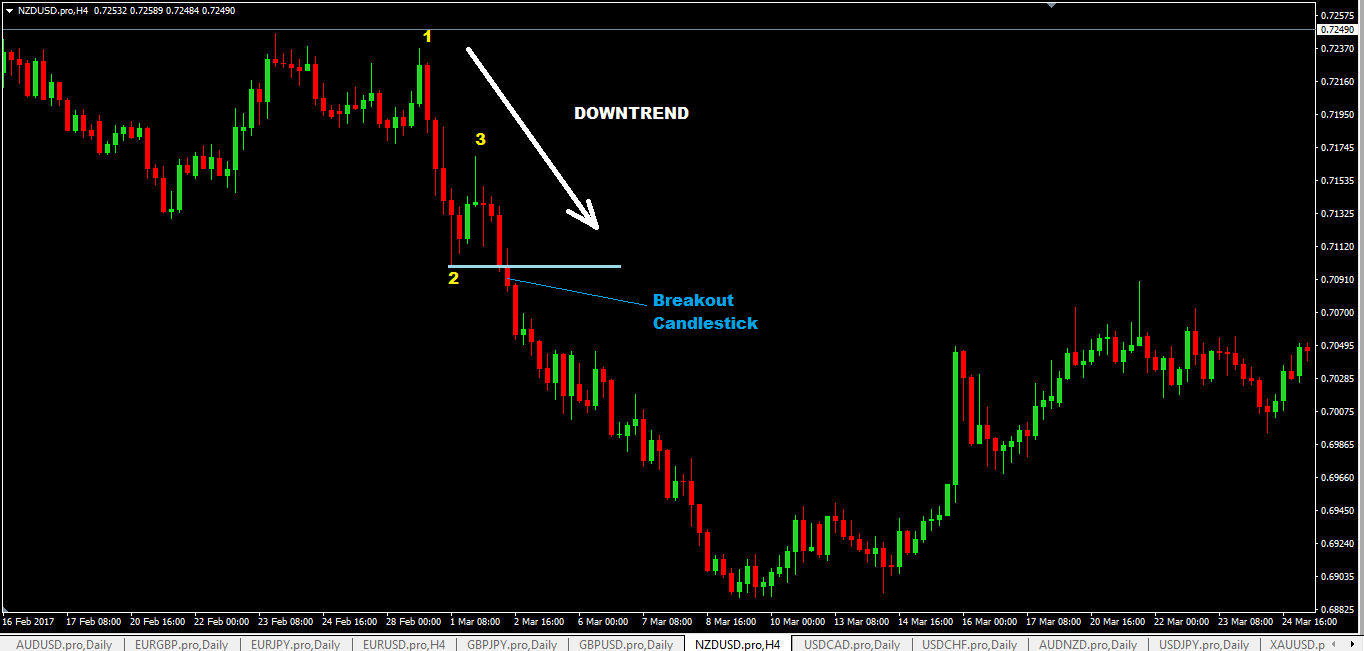

These two charts below show the difference between the 123 chart pattern in a downtrend and an uptrend.

This is 123 chart pattern in an uptrend:

This is 123 chart pattern in a downtrend:

How To Trade The 123 Chart Pattern

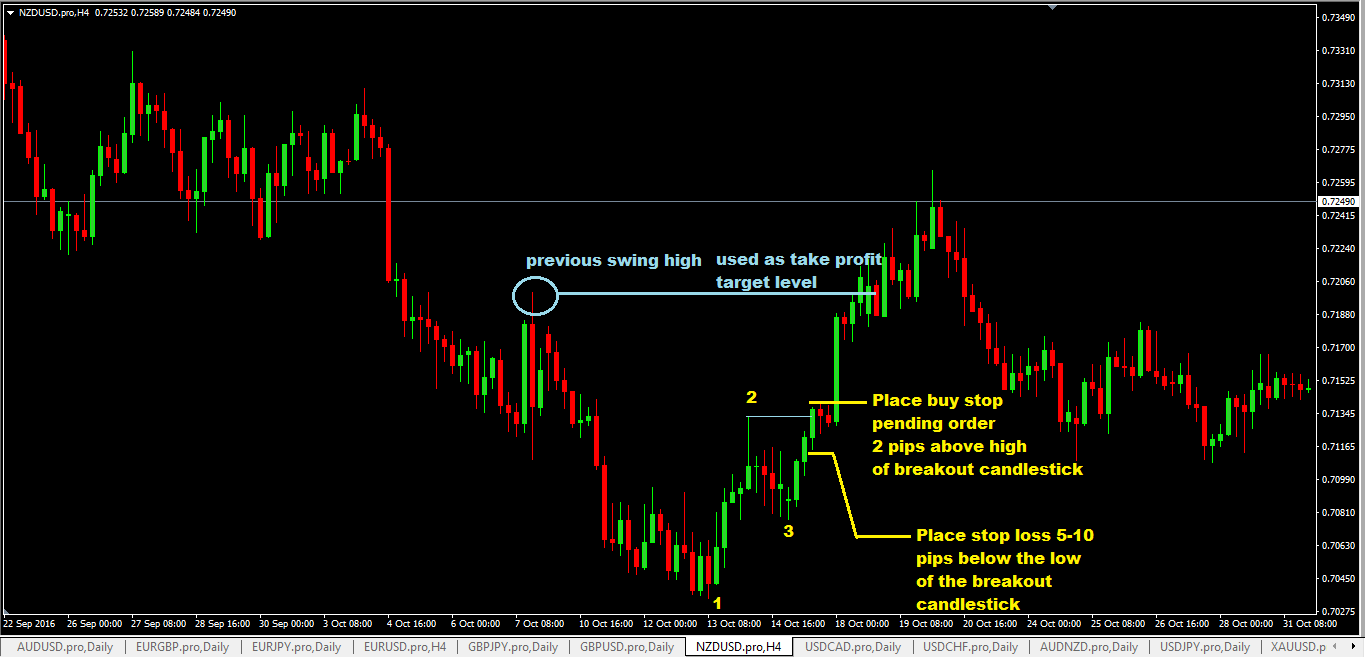

Buying rules:

- once you’ve identified the 123 chart pattern, wait for a breakout candlestick. The breakout candlestick must breakout to the upside and close above point 2.

- place a buy stop pending order 1-2 pips above high of breakout candlestick

- place your stop loss 5-10 pips below the low of the breakout candlestick.

- for take profit,you can calculate it based on 1:3 risk to reward or use a previous swing high as your take profit target level.

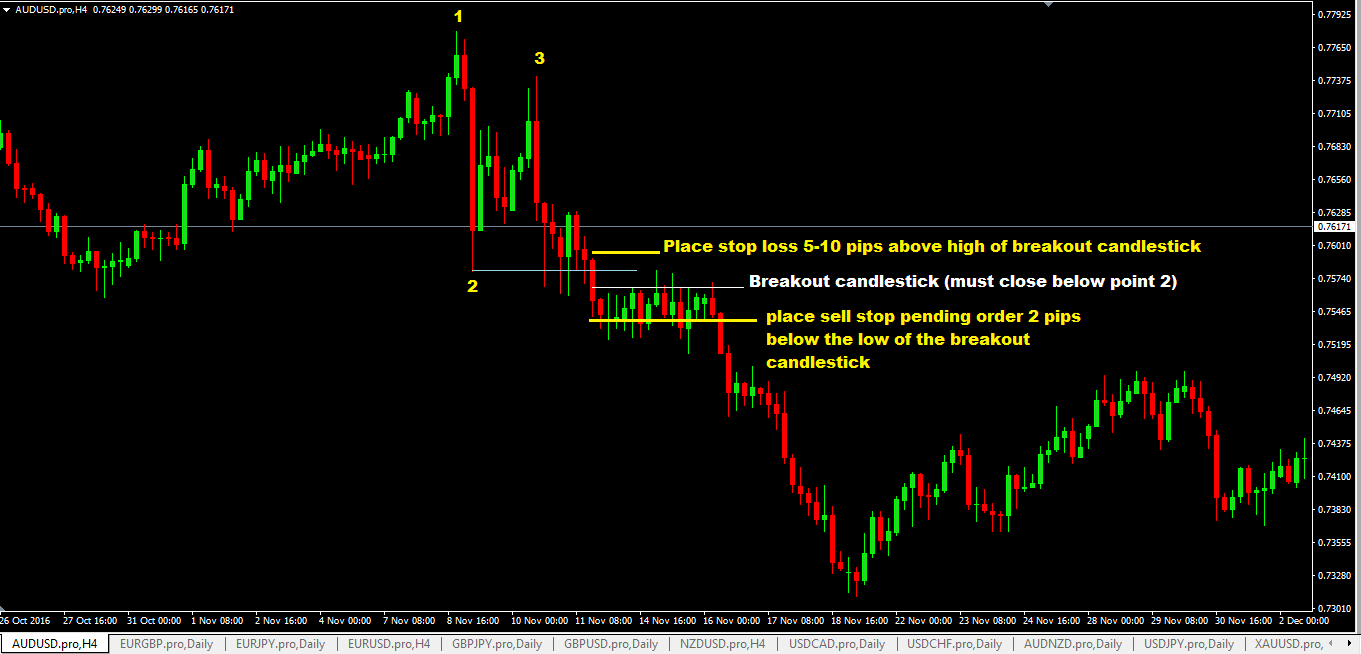

Selling Rules:

- once you’ve identified the 123 chart pattern in a downtrend, wait for a breakout candlestick. The breakout candlestick must breakout to the downside and close below point 2.

- place a sell stop pending order 1-2 pips above low of breakout candlestick

- place your stop loss 5-10 pips above the high of the breakout candlestick.

- for take profit,you can calculate it based on 1:3 risk to reward or use a previous swing low as your take profit target level.

Another way to Trade The 123 Chart Pattern

The trading rules given above are based on the breakout candlestick closing above/below point 2.

If you don’t want to wait for the breakout candlestick, then you can place your sell stop/buy stop pending order 2 pips below/above the point 2.

Advantages of the 123 Chart Pattern Forex Trading Strategy

- a very easy price action trading system with really simple trading rules.

- in a good and strong trending market, you can use multiple 123 chart patterns setup and add more trades as trend continue thus pyramiding your way to increase profits.

Disadvantage of the 123 Chart Pattern Forex Trading Strategy

- sometimes the breakout candlestick may be extremely long which means your stop loss distance will also beg long reflecting this.

- new forex traders may find identifying the 123 pattern difficult at first.

- false breakouts can happen.

If you enjoyed and liked this forex trading strategy, please don’t forget to share by clicking those sharing buttons below. Thankyou.