The 38.2 fibonacci level for trading strategy is based on the 38.2 fibonacci retracement level.

Background

Sometimes, when the price is in an uptrend, it will start to reverse back down temporarily until it hits the 38.2 fibonacci retracement level and then it will bounce back up.

Similarly, in a downtrend, price will start to rise up temporarily, only to hit the 38.2 fibonacci level and start falling down again.

How Do Draw the 38.2 Fibonacci Level Using The Fibonacci Tool In Mt4

If you are using the metatrader4 trading platform, using the fibonacci retracement tool is really simple.

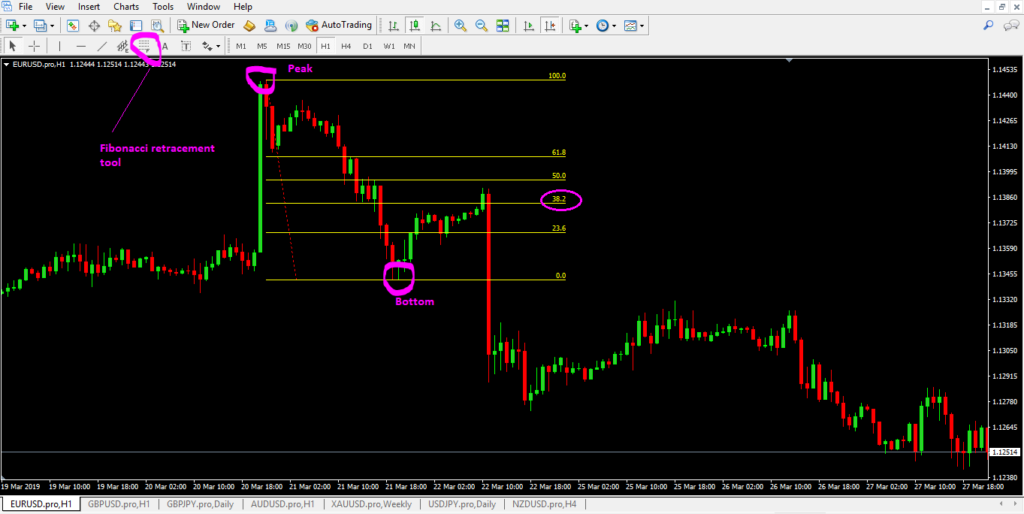

If you look at EURUSD 1 hr chart below, you can see market make a peak and started to fall. But sometime later, price started to rise up. Where it rose up from created a bottom (support level)

But this price rally was short lived as you can see, when price hit the 38.2 fibonacci retracement level (resistance), it fell and went past the bottom that was created.

To draw a fibonacci retracement level (it can be 23.6, 38.2, 50, or 61.8) in a downtrend, these 2 must must already happen:

- a peak is formed first

- and the bottom

And the next thing is that price must be rising up from the bottom.

And the big question is: at what level is price going to start falling back down. That’s where the fibonacci retracement tool comes into play.

Do draw a fibonacci retracement level in a downtrend, there are only two simple steps.

Step 1: Click the fibonacci retracement tool

Step 2: Click on the peak, hold and drag down to the bottom and release. These will draw all those different fibonacci levels on your chart on any timeframe you are using.

So now you wait to see if price will reach the 38.2 fibonacci level and if it is going to fall from there.

So how do you you know if price is going to fall from the 38.2 fibonacci level?

Well, to be honest, you won’t know. But the best alternative is to study the price action patterns around that level and see you are seeing bearish reversal signal(s) there and take a sell trade based on that.

Study these forex reversal candlesticks patterns for you own benefit.

How To Draw Fibonacci Uptrend?

You simply to the exact opposite of what you would have done in an uptrend.

Price must already make a bottom and has risen up, make a peak and has started to fall but hasn’t gone past the bottom yet.

Step 1: Click the fibonacci retracement tool.

Step 2: Click on the bottom, hold and drag up to the peak and release. These will draw all those different fibonacci levels that price may hit and rise up from including 38.2% fibonacci level.

The 38.2 Fibonacci Level Forex Trading Strategy Rules

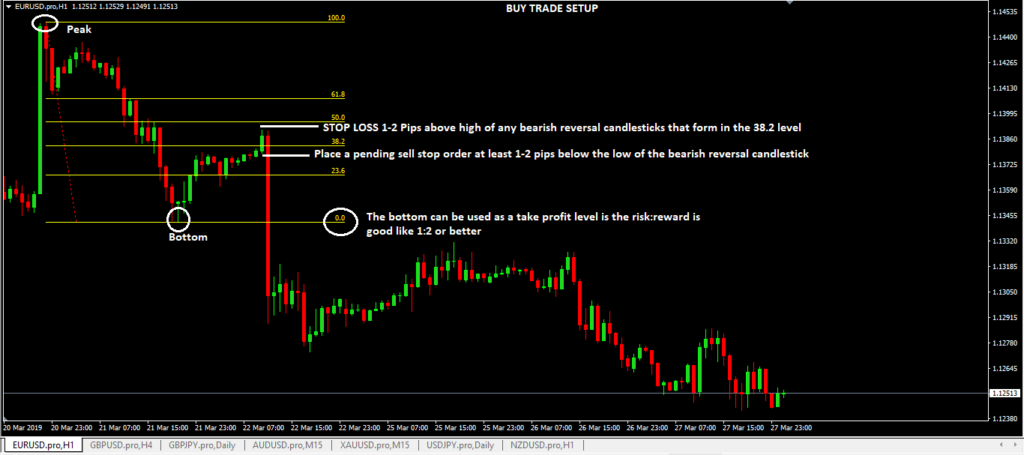

I’m just going to give the selling rules here but for buying rules, it is the exact opposite so there should be really no confusion at all.

Here’s how to sell using price action on the 38.2

Step 1: Wait for price to come up to the 38.2% fibonacci retracement level

Step 2: When a bearish reversal candlestick pattern forms on the 38.2% level, then place a pending sell stop order 1-2 pips below the low of the bearish reversal candlestick

Step 3: Place your stop loss 1-2 pips above the high of the bearish reversal candlestick if you are trading larger timeframes like the 1hr and upwards but if smaller timeframes, you need to consider the spread and place your stop loss

Step 3: Place your take profit target on the 0.00% fibonacci level which will be the bottom that price made if the risk:reward is 1:2 or better.

Advantages

- a very simple but good price action trading system in a strongly trending market.

- risk:reward ratios are good.

- market tend to respond to these levels, especially 38.2 and 61.8 so it is a another system to keep up your sleeves to trade such situations.

Disadvantages

- simply just trading the 38.2% fib level without the use of reversal candlestick patterns. Why?

- Because price can still go past 38.2% fib level and reverse down from 50& or 61.8 level so knowing reversal candlestick patterns is important in my opinion. Otherwise, you will be just guessing.

- like all trading systems, it has it weakness: flat or sideways market is not good for this system.