The daily candlestick breakout forex trading strategy is a forex trading strategy based on trading the breakouts of daily chart candlesticks. This forex trading strategy needs to be tested to verify its validity/usefulness.

But the idea behind it is really simple and it is this: on the daily chart, if you see a a bullish candlestick in an uptrend, the chances are the next candlestick that forms will also be a bullish candlestick.

Similarly, if you see a bearish candlesticks in a downtrend, the chances are the next daily candlestick to form after it will also be a bearish candlestick.

So based on this idea, we can create trading rules on how to trade the daily chart candlesticks.

Trading Parameters

Timeframes: only daily

Currency Pairs: Any good trending currency pairs

Forex Indicator: 14 day exponential moving average

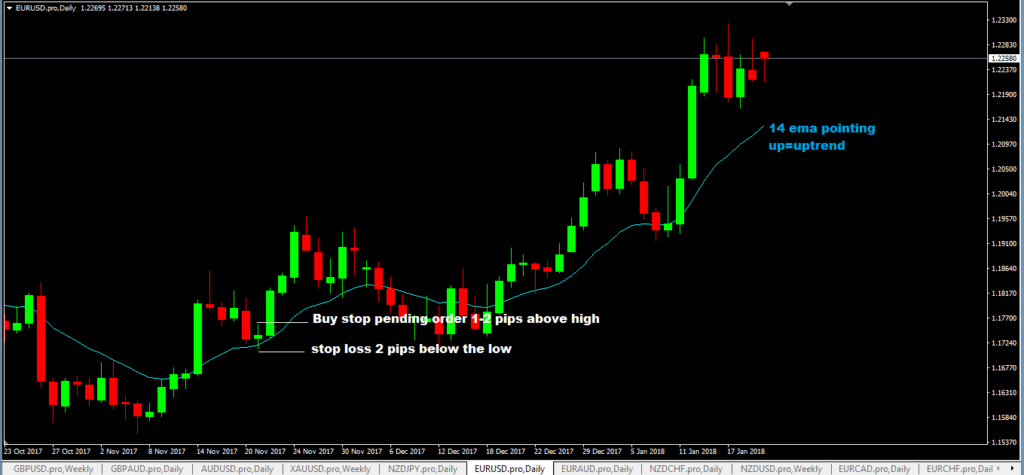

Buy Trading Rules

- The prices on the daily chart must be in an uptrend: prices will be above 14 ema.

- When a bullish candlestick forms, place a buy stop order 1-2 pips above the high.

- Place your stop loss at least 2 pips below the low of that candlestick.

- For take profit, aim for risk:reward of 1:3

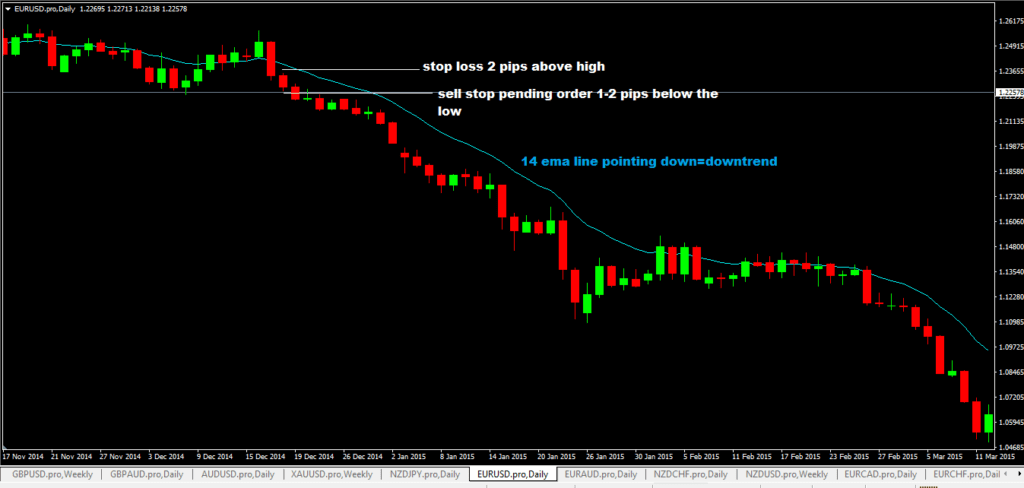

Sell Trading Rules

- The market must be in a downtrend on the daily charts: prices will be below 14 ema

- When a bearish candlestick forms, place a sell stop pending order 1-2 pips below the low of the bearish candlestick

- Place stop loss 2 pips above the high of that bearish candlestick

- For take profit, aim for 3 times what you risked, i.e. 1:3 risk:reward ratio.

Advantages of Daily Candlestick Breakout Forex Trading Strategy

- If you focus on trading 1 currency pair only, that means you only have 1 trade per day, which essentially reduces over-trading

- you are trading with the trend (not against it)

- this can be a set and forget type of trading system and you don’t need to monitor your trade regularly as it is based on the daily chart.

- really simple trading rules.

Disadvantages of Daily Candlestick Breakout Forex Trading Strategy

- The length of the daily candlestick determines the length of the stop loss…the greater the length of the daily candlestick, the greater the stop loss distance. One suggestion is to avoid trading extremely long daily candlesticks.

- avoid trading when price is near major swing points/levels or support and resistance levels.