The Dark Cloud Cover Pattern Forex Trading Strategy is a forex price action trading system designed to capture bearish market reversals.

In here, you will learn what a dark cloud cover pattern looks like and how to trade it.

Trading Parameters & Requirements

- Currency pairs to trade: any

- timeframes: you can use the daily or the 4hour timeframes for this trading system.

- Indicators: none is required but you may need the zigzag indicator mt4 for managing your trailing stop to lock in profits as trade moves in your favour.

The Dark Cloud Cover Pattern Explained

When dark cloud cover patterns form in resistance levels, they indicate that the bulls may be losing steam and the bears are now taking over and price may start dropping, forming a downtrend.

The potential for selling at the very top can be achieved with this trading system.

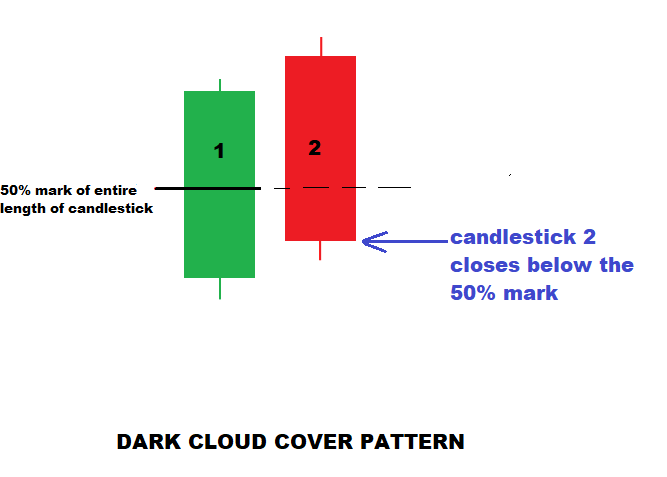

The dark cloud cover pattern is a 2-candlestick pattern and it is a bearish reversal candlestick pattern:

- the first candlestick is a bullish candlestick

- the second candlestick is a bearish candlestick that must close at 50% or more than 50% of the length of the first candlestick

- also, the low of the 2nd candlestick must not go below the low of the first candlestick, otherwise that would turn out to be a bearish engulfing pattern.

The Selling Rules Of The Dark Cloud Cover Pattern Forex Trading Strategy

Since this is a bearish candlestick pattern, you only need to look for selling opportunities.

The ideal chart locations where you should be looking to sell are levels where price has been heading up in a bullish trend and hits resistance levels.

- When a dark cloud cover pattern forms, place a sell stop order 1-2 pips under the low of the 2nd candlestick

- place your stop loss 2-10 pips above the high of the 2nd candlestick

- for take profit, aim for 1:3 risk to reward ratio or otherwise, look for previous swing lows and use them as take profit target levels but makes sure the risk:reward is 1:2 or greater before you used them.

- Trade management: if price goes as expected, the use trailing stops to lock in your profits.

Advantages of The Dark Cloud Cover Pattern Forex Trading Strategy

- fairly simple pattern to spot and trade

- simple trading rules

- you can achieve very good risk:reward outcomes with this trading system

- if you use swing trading and use larger timeframes like the daily or the 4hr, the potential for making 100 pips or more profit in one trade is there.

- this system can also be used on a smaller timeframe for scalping

Disadvantages of The Dark Cloud Cover Pattern Forex Trading Strategy

- not all dark cloud cover patterns that you can spot on your chart are tradeable. It is where they formation, or their location of where the form on the chart that matters. So you need to fist do your own homework and find out first the possible price turning points and then wait for this dark cloud pattern to form. Levels like: resistance levels, support turned resistance levels, downward trendline bounces, fib retracement levels should be marked or already known before hand.