The double top chart pattern forex trading strategy is a price action trading system based on the double top pattern.

The double top chart pattern is a bearish reversal chart pattern that forms in an uptrend.

When it forms, it indicates that the uptrend may be changing to a downtrend.

Currency Pairs To Trade?

You can trade any currency pair with this trading system.

Timeframes To Trade?

I suggest you use 15 minute timeframe and upwards.

Any Forex Indicators Required?

You don’t need to complicate things by using indicators. No need.

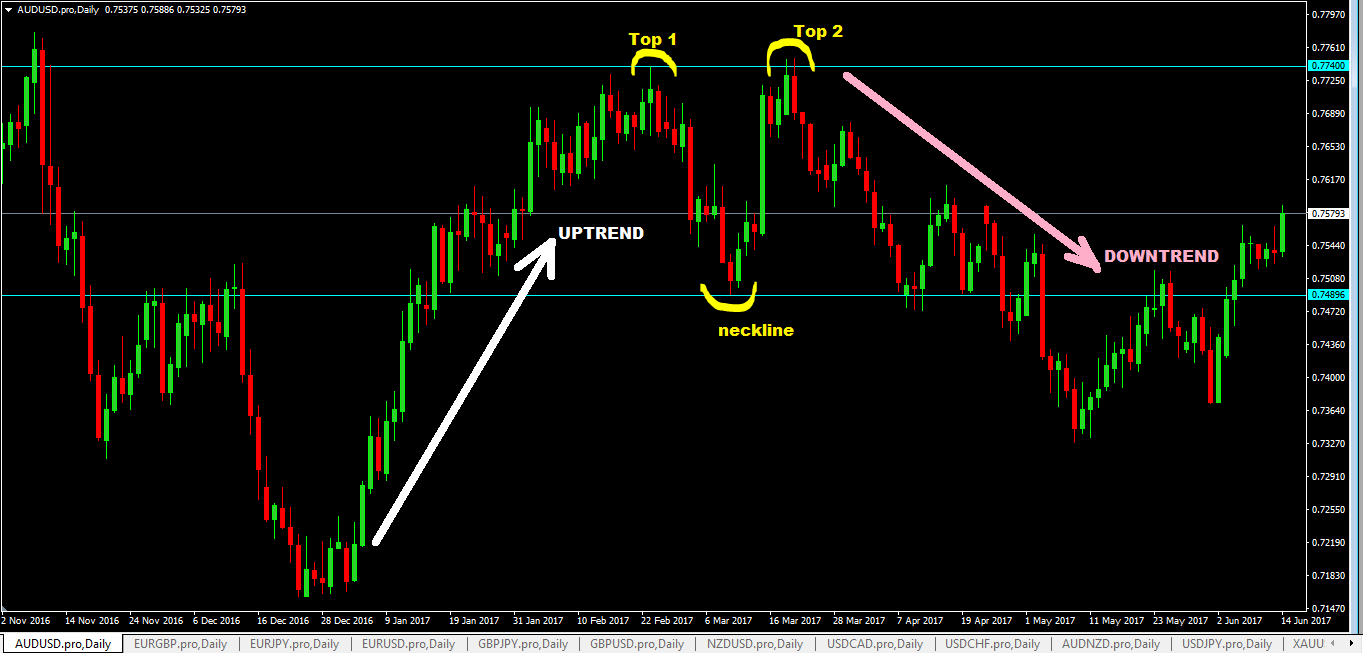

Example of Double Top Chart Pattern

Here’s an example of a double top chart pattern:

- as you can see, price has been in an uptrend until the double top chart pattern formed and then it turned down.

- what is important to note also is that the top 1 and top 2 should be around the same height.

Double Top Chart Pattern Forex Trading Strategy Rules

The rules of the double top chart pattern forex trading strategy are really simple:

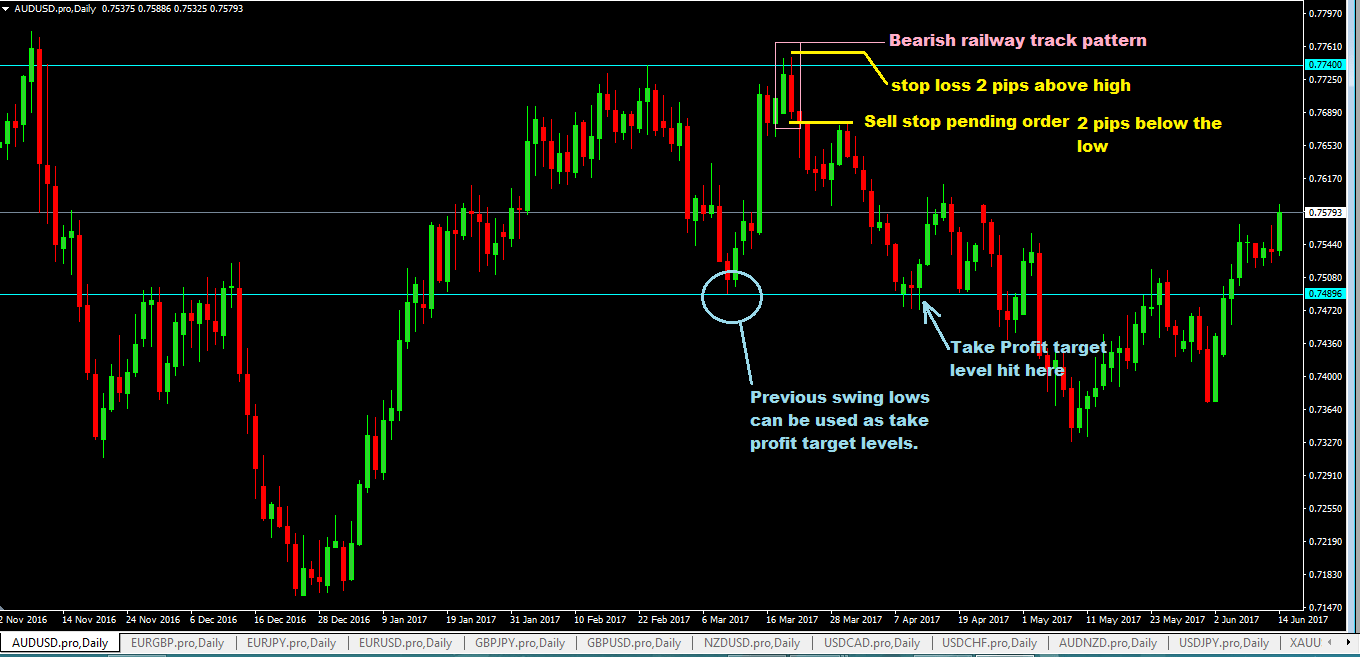

- place a pending sell stop order when you see a bearish reversal candlestick form on top 2.

- place your stop loss 2-5 pops above the high of that bearish reversal candlestick pattern.

- for take profit, you can use previous swing lows as yoru take profit levels or if not, calculate your profit target based on 1:3 risk to reward ratio. For example, if your stop loss is 20 pips then your profit target must be set a 60 pips.

Advantages of the Double Top Chart Pattern Forex Trading Strategy

- this forex trading system has a really excellent risk:reward ratio for trades that work out as anticipated.

- price moves downward tend to go hundreds of pips, sometimes even to the thousands if you are trading from the larger timeframe like that daily so if you trail stop your trade, you have the potential to capture most of these kinds of moves if you do not get stopped out too quickly.

- the use of bearish reversal candlesticks will really help you better time your sell trade entries.

Disadvantages of The Double Top Chart Pattern Forex Trading Strategy

- price spikes tend to happen around top 2 zones and if your stop loss is not far away enough, you may get stopped out prematurely.

- beginner forex traders may take a while to know if a double top chart pattern is forming or not.

Please don’t forget to share this double top forex trading strategy with your friends by clicking those sharing buttons below. Thanks.