When you deposit your hard earned cash into your bank, do you think your money is in the vault of your bank?

No.

You see, years ago, some clever bankers realized that not all people will withdraw their money at once at the same time.

Which means that there will still be huge reserves of cash still available in the bank.

So what did the bankers do?

They decided to loan out the money held in the reserves (their client’s savings) in order to make additional profits.

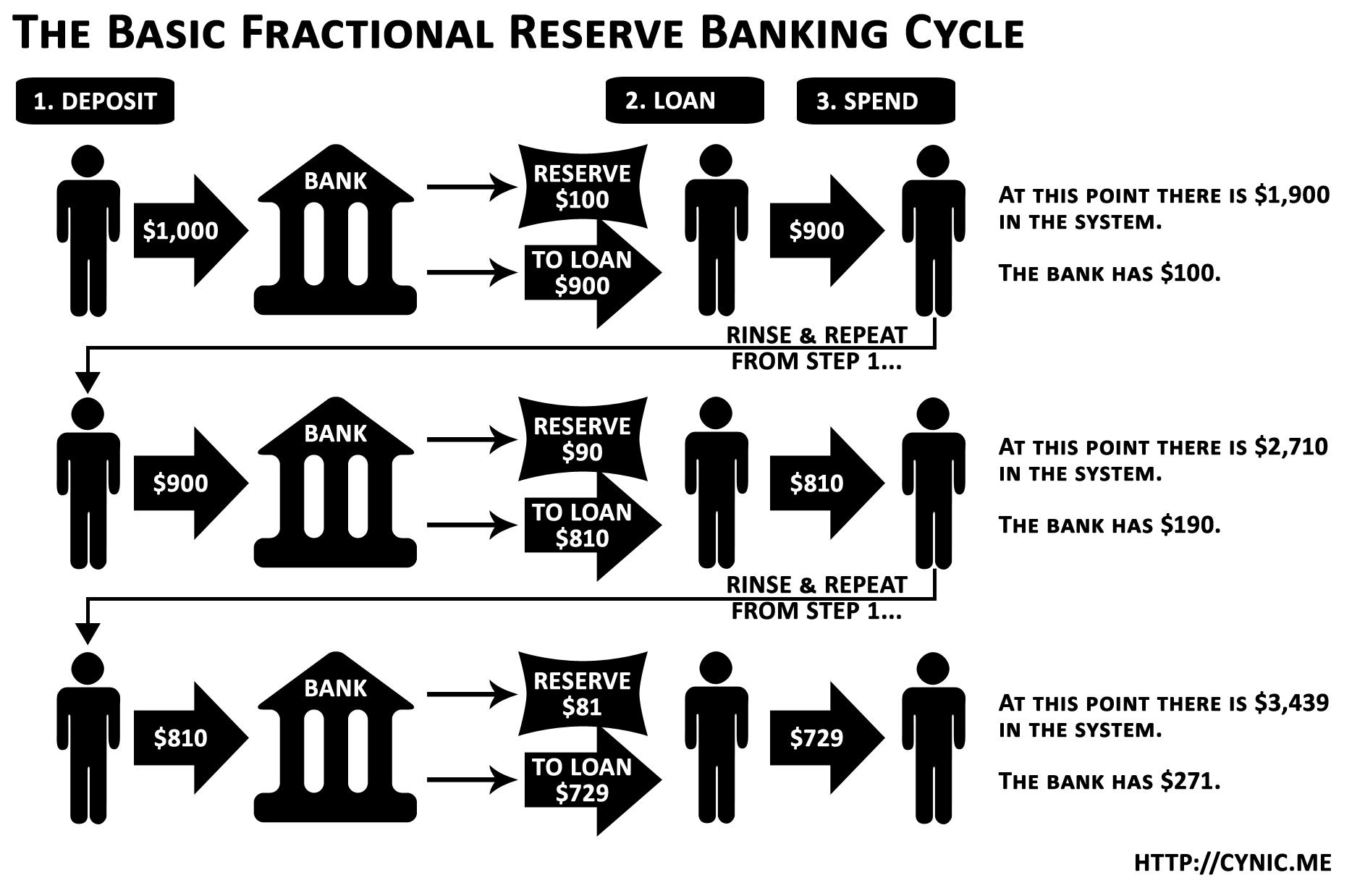

This system is known as fractional reserve banking.

Definition of Fractional Reserve Banking:

Here’s definition by wikipedia:

Fractional-reserve banking is the practice whereby a bank accepts deposits, makes loans or investments, but is required to hold reserves equal to only a fraction of its deposit liabilities. Reserves are held as currency in the bank, or as balances in the bank’s accounts at the central bank.

Here’s the problem: what happens if people fear that the financial system is going to collapse and they all rush to the bank to get their money back?

Well, that means the party if over for the banks!

And the fraud is exposed…