When I first started becoming interested in learning how to trade commodities, I started by demo trading for a while.

After that, my next decision was to start trading real money, and so I was faced with this question of: How to choose a good broker?

I wanted to start trading for real with a live trading account, instead of playing around with virtual money. I needed to get started in trading and fund my trading account with real, live, cold hard cash!

Eventually, every beginner trader has to come to this point: Choosing a broker to open a live trading account with.

And with so many brokers competing for your attention, how do you pick the right one?

How To Choose A Broker – 8 Step Process

You cannot trade without a broker. You need brokers just like you need oxygen for your lungs in the trading world.

Don’t have the patience to read the whole article; Join AvaTrade.com.

These are the 8 steps process I used to choose a broker.

Read Broker Review Websites

Yes, You read that right. Now you are wondering why I’m telling you to go to Brokers review websites to read the reviews and ratings right after I’ve told you “not to trust” Brokers review websites. Well, you are doing it for one reason only: To get a rating.

Which Forex brokers review website did I use? I used ScamBroker.com.

You need to find forex brokers with 4-star ratings and above. Remember that: 4-star ratings and up! Ratings must come from a lot of people.

A rating of 5 stars from just 5 traders is suspect. Likewise, a rating of 3 from just 5 traders is not good. Ignore such forex brokers that have reviews from very few people. The whole idea is based on what I would call the ‘truth factor”. Most traders who give reviews and ratings do tell the truth, but only a few will not.

Based on this, it can be reasonably assumed that if a 3-star rating (and up) comes from a large number of traders, then that rating is a “rough” but good indication of what type of forex broker it is.

Is The Broker Regulated?

The second step in how to choose a forex broker is making sure, you are dealing with forex brokers that are regulated.

So after I got all the forex brokers that had 3 star ratings, I wanted to make sure they were regulated or not. This is, without a doubt, the number 1 thing you should be checking before anything else.

Why do you need forex brokers to be regulated?

Well, when a forex broker is regulated, that means there’s usually a government regulation that exists to make sure that the activity conducted by the forex broker follows certain strict guidelines. This also means that there are regulatory agencies that monitor the compliance of these guidelines.

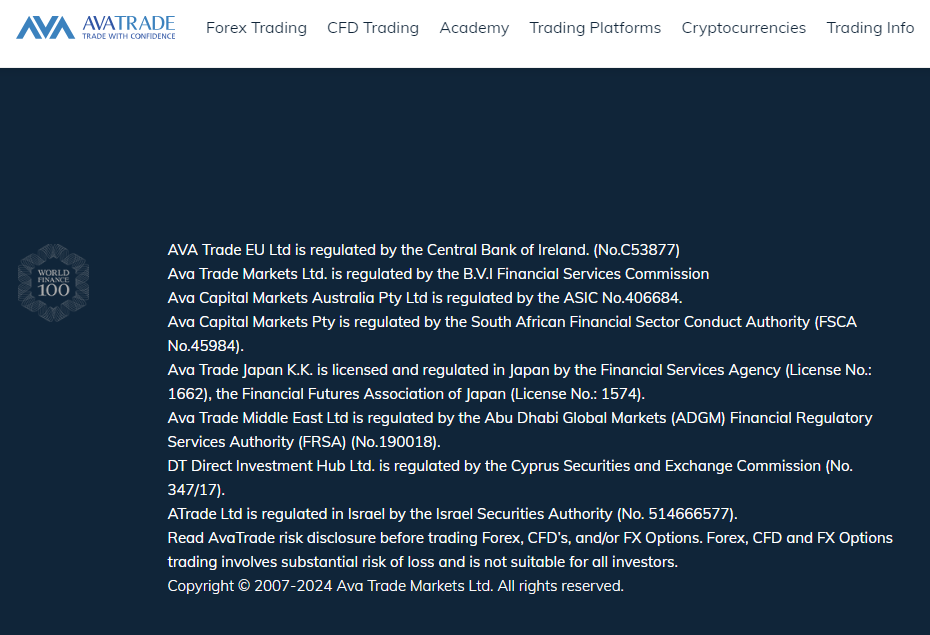

So how do you find out if the the forex broker is regulated or not? Well, the first thing to do is go to the forex brokers website and check to see if they are regulated and if so by what regulating agency. That information is generally placed on the footer of their website.

For example, for the AvaTrade forex broker, here’s what you will see on the footer of their website:

Learn more about the benefits of broker regulation, Go Visit AvaTrade.com.

Now, if you don’t believe what you see on the forex broker’s website, you can go a step further by searching on forex broker review websites to confirm this information or contact the regulating agency to confirm if the forex broker is regulated or not.

Here is a list of Regulatory Agencies in different countries:

- United States: National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC)

- United Kingdom: Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA)

- Australia: Australian Securities and Investments Commission (ASIC)

- Switzerland: Swiss Financial Market Supervisory Authority FINMA (FINMA)

- Germany: Bundesanstalt für Finanzdienstleistungsaufsicht (BaFIN)

- Canada: Investment Industry Regulatory Organization of Canada (IIROC)

How Long Has This Broker Been In Business?

Being in the forex broker business is tough. Just imagine for a minute what it would take to set up a business as a forex broker:

- Imagine the paperwork that it would take

- The regulatory compliance requirements that need to be undertaken to get regulated

- Cost of setting up the infrastructure (hardware, software)

- Expertise that needs to be hired (lawyers, software engineers, managers, employees, etc.)

- The time it would take to set up and run effectively.

- Finances that are required to get it off the ground to start running.

I can give a lot more, but you get the point I’m trying to make. You want to select a forex broker who has proven itself to be in business for a long time. The longer the time frame a forex broker has been in business, the more stable that forex broker is (generally speaking).

What is an adequate time frame to be in business? Well, as a rule of thumb: 5 years. Look for forex brokers that have been in the business for 5 years or longer, nothing less. With such forex brokers, you know they have a reputation to protect and you know they have solidly established themselves.

The risk of opening live accounts with newly established forex brokers is that:

- They have not established their reputation yet (it is a factor of time)

- There will be a lot of things about them that you will not know yet.

- If they go under, you can say goodbye to your money.

What Country Did The Broker Establish Their Business In?

This is one factor that tends to be overlooked by many forex traders but in my case, when I started looking to choose a forex broker, I wanted forex brokers to be established in a country where I know the country is “tough” when it comes to regulatory compliance.

This is my personal preference but I prefer; the USA, United Kingdom, and Australia.

Generally speaking, these countries have really good regulatory agencies that make sure the forex brokers are doing their business right so you as a customer can be protected. I will be very reluctant to open live trading accounts with forex brokers that operate in countries where my personal trust factor is low. Think Seychelles, Vanuatu, Marshall Islands etc.

Ease Of Deposit And Withdrawal

There will be a few odd forex brokers that make it easy for you to deposit funds for trading but make it so hard to withdraw it or any profits you make.

I’ve read of cases like this in forex brokers review websites and that is kind of scary. But here’s the big problem: you will only know this (deposit and withdrawal) when you experience it yourself. So what I suggest is that when you’ve selected a forex broker to open an account with, deposit an amount of money that you will not lose sleep over.

Trade it for a while and when you make some profit, withdraw that profit and see if it is going to be hard or easy. Only then, you will really know!

Once the forex broker passes the test of “ease of deposit and withdrawal” then you can start thinking about depositing larger sums of money into your forex trading account for trading.

Trading Platform Choices

I was already hooked into the MT4 trading platform whilst demo trading so it was really a no-brainer for me to choose a forex broker that offered the MT4 trading platform. The thing I love most about the MT4 trading platform is its user-friendliness and its ease of use. Make sure you choose a forex broker that has the trading platform you are familiar with or you want to use.

A broker like AvaTrade has multiple choices of trading platforms.

Another important point about trading platforms is to make sure that the forex broker provides it to you free of charge. Don’t be foolish and end up paying monthly subscription fees for the use of trading platforms. You will be just burning money.

The market information you get from free trading platforms like MT4 are the same as those that you’d be getting from subscription-based forex trading platforms.

Trade Execution

The next step on how to choose a forex broker is based on their trade execution.

The problem with selecting a broker based on their trade execution is that this is something you will know only after you’ve actually opened a live account with a broker.

Why is broker trade execution important?

Here’s why:

When you click the buy and sell button, your forex broker must fill up your orders at the price that you wanted or at the best possible price under normal market conditions, otherwise, you will get your orders filled at the worst possible price.

Let me explain what a normal market condition is: a normal market condition is when there are:

- no important news to excite the market (which mean high volatility) &

- no surprise events

Which means the market should have normal liquidity.

Let me give an example: let’s assume that you have a stable internet connection, if you click “sell” EUR/USD at 1.4000, you should sell at that price or within micro-pips of it.

And there shouldn’t be any delays in getting your sell order filled.

Why? Simply because if there is a delay, your order can get filled at the worst possible price. Also, if you intend to be a scalper, the speed at which your order is filled is very important.

What I suggest is that you test out the forex broker first. What you do is deposit a sum of money that your wife will not strangle you if you lose, into your live forex trading account with your new forex broker and test out the trade execution of the forex broker, and see for yourself.

This, unfortunately, is one thing that you cannot really get the truth by reading forex broker review sites but by doing it yourself and experiencing it.

Customer Service

The final step on how to choose a forex broker is based on customer service.

Why customer service? Well, don’t we all hate those companies where we ring and are put on hold for minutes? Similarly, we hate companies that we email about certain information but do not get a reply back fast enough or worse, we get no reply at all!

Forex brokers are not angels. A forex broker that deals with customer issues quickly, reliably and professionally tells you a lot about the forex broker you are dealing with.

A few quick ways to gauge quickly how good the customer service of a forex broker is before opening a live account with them is by doing these:

- Send an email using the contact address on their website and ask a few questions and see how long it takes for them to respond. Allow for different time zones, if they are based in a different country.

- Get a phone and ring them up and ask them a few questions, and see if you are put on hold or see if they are helpful or not.

Forex brokers know how important customer service is and all it would take is for one grumpy customer to post a negative review on a Forex website. That can stop many traders from opening live accounts with them.

That’s why any reputable broker you open a trading account with should be fairly good with their customer service.

Summary

So there you have it. I have given you the 8 steps process on how to choose a forex broker. Out of these 8 steps process, the following 3 are the most important:

- The forex broker is regulated!

- They have been in business for a while.

- Make sure the broker is established in a country that you can trust. One with strong regulatory compliance rules and processes that brokers must adhere to.

If these 3 conditions above are satisfied, the remaining 5 conditions will fall in line as well.

Do not trust and believe everything you read in forex brokers’ review websites. Those bad reviews will scare the living daylights out of you and as you’ve read in my case. I ended up opening up my forex trading account with a so-called scam forex broker and guess what? Never had any major issues with them at all.

As suggested, if it’s your first time to open a live forex trading account with a forex broker, you should deposit a small amount of money at first and test the forex broker out:

- Test them out for ease of deposit and withdrawal

- Check their execution and speed of execution

- See if you like their customer service

After you are satisfied with the forex broker, you can deposit the rest of the money you planned initially, into your forex trading account.

So Many Forex Brokers, Which One To Choose?

What is the best forex broker to choose? How do I pick one? Will my money be safe?

Start with AvaTrade.com, because they have been around for years.

These were the questions running through my mind. But that itself was not the real problem as I found out.

The real problem was going to forex brokers review websites and reading those reviews. The good reviews made me excited, thinking that I was finally going to pick the best forex broker. Until I started reading the first negative review, and that scared the living daylights out of me. And the more negative reviews I read, the more indecisive I became.

How?

Well, you’ll have a customer praising a forex broker and giving a 5-star rating and then another customer giving a bad review even to the point of calling that forex broker a “scam forex broker.”

Now, when the word scam gets thrown around in a forex brokers review website, it actually puts off a lot of new traders from opening up live forex trading accounts with that particular forex broker.

Why?

Nobody wants to lose money to a scam forex broker! That’s why!

In this article, I will share my experiences in finding my first forex broker and the do’s and the don’t of choosing a forex broker. Since then, I have had the experience of opening at 3 live trading accounts, with 3 different forex brokers in different countries, and never really had any major issues with them in terms of depositing funds and withdrawing funds from my forex trading accounts.

And that is because I used an 8 steps process on how to choose a forex broker.

What Forex Brokers Review Sites Don’t Mention

When you are a new forex trader, the first thing you’d do when you decide to start trading forex with live money is to go to Google and type: [name of forex broker] reviews.

Once you press the enter button, there will be a massive list of websites that will have forex brokers’ reviews written about them.

I got bad news for you! If you are going to use forex broker reviews websites to find your forex broker, you’ll never find an “angel” broker.

Why? Simply because everyone has a different opinion or experience. Here’s the one thing that kinda sucks about forex broker review websites: they don’t tell you the complete truth about a particular forex broker.

Why? Well, let’s say that a forex broker review website is just there to get experiences or opinions of traders about forex brokers, then guess what?

There will be those who love the forex broker and those who hate it.

With so many different reviews about a forex broker, you will be left utterly confused, and it would seem as if every forex broker is a scam.

How I Chose A “Scam” Forex Broker

Yes, my first forex broker was a so-called scam forex broker. But my experience was…well…different!

So, here’s what I did:

- Being a forex newbie, I combed through the forex brokers review sites to see if I could find the best forex brokers and choose one to open my live forex trading account with.

- I saw reviews about reputable forex brokers that made me nervous.

- The forex broker that I eventually chose was even called a “scam” forex broker. I’m not going to mention names here but, it averaged a 3.5-star rating on the Forex broker review site.

- To make it worse, that forex broker was registered in another country. Which meant that I had to send money overseas to fund my live account.

To tell you that I was nervous sending money for the first time overseas to a forex broker that I did not know is an understatement: I was freaked out!

- Will that money show up in my Forex trading account?

- What if this forex broker is truly a scam as they said in the review? That will mean that I’ll never see my money again.

These types of questions popped into my mind. But regardless, I had to do it and find out for myself. It was now or never!

You can imagine the surprise I had when that money (US$3,000) showed up in my Forex trading account when I opened up my MT4 trading platform 2 days later! (That was because I used international money transfers through my bank).

If I had used a credit or debit card, it would show up instantly on the Forex trading account. I placed my first trade. Wow! How excited I was. I started trading for real.

Since then, I’ve had the experience of depositing and withdrawing money from my forex trading account with that particular forex broker without any issues at all. And the surprising thing was that “this” forex broker was labeled a scam forex broker in a forex brokers review website.

So who do you trust when you want to choose a forex broker?

A forex broker review website? Nope. Or you can do the same thing I did… which is follow the exact same steps I used to choose a forex broker.