What is multiple timeframe trading?

- How to you trade in multi timeframes? What is the process?

- What kind of technical analysis is involved in multiple timeframe trading?

- What kind of forex trading strategies can you use in multi timeframe trading?

- What are the benefits of multiple timeframe trading?

I follow a 3 steps process when it comes to trading forex in multiple timeframes and I will explain the steps and the process I go through to do that.

But first, let me be clear from the start about two things:

- my techniques of multiple time frame trading may be different to others that you may have seen/read

- The second thing you should know is my techniques of multiple time frame trading is strictly based on price action trading only. I am not going to teach you about multiple timeframe trading based on forex indicators.

I hope that at the end of it, you should have a fairly solid understanding about trading in multiple timeframes.

Let’s get started…

What Is Multiple Timeframe Trading?

This is the definition of multiple timeframe trading: multiple timeframe trading is the art of trading using many different timeframes for the purpose of finding the best possible trade entries and exits.

So why would a trader go through the hassle of finding the best possible trade entry or exit?

Because:

- It makes sense to really have a good entry point in your trade as this allows you to minimize your trading risk

- Secondly, you expect the market to keep moving in the direction it was going previously or as soon as you enter a trade, you expect the market to start changing soon after.

What about exit? Well, multiple timeframe trading allows you to find the best possible exit points or levels for your trade.

These exit points or levels are used as your take profit targets. Similarly, multiple timeframe trading also allows you to use trailing stop and ride the trend to it maximum until your trailing stop loss gets hit or your take profit target gets hit.

Why Use Different Timeframes?

The 2 main reasons why I use different timeframes in multiple timeframe trading is:

- Find the best trade entry point or price level to enter a trade.

- Look for trading setups in different timeframes as each timeframe can hide a trading setup which you cannot see when you are on another timeframe.

That’s all there is to it.

If you are only trading using one timeframe, your view of the market is limited to what you can see in that timeframe.

Its like looking through a keyhole: you can only see so much.

Why? Because each timeframe gives a certain perspective of what is happening in the market, that’s why.

So this means that if you look at one timeframe, you may not see any reliable buy or sell signals but if you switch to another timeframe, you will see a good buy or sell signal based on candlesticks and chart patterns that from in that timeframe.

The 3 Steps Of Multi Timeframe Trading

This is the 3 steps process I use to do multiple timeframe trading:

- Looking For Trading Setups Using Top Down Technical Analysis

- Switch To A Lower Timeframe And Look For Buy Or Sell Trigger(s)

- Manage Your Trade

1. Look For Trading Setups Using Top Down Technical Analysis

What is top down technical analysis? And What is the main purpose of it?

Top down technical analysis is the process of technical analysis where you start looking or searching for trading setups starting from the larger timeframe first, which is the monthly timeframe and then work your way down to lower timeframes. Top down technical analysis is like an eagle that is very high up in the sky looking down. The eagle’s eyes miss nothing…it sees everything.

For my case, I mainly use the monthly, weekly, daily, 4hr and the 1hr timeframes.

Here’s what I do:

- I open up the monthly chart and look for trading setups.

- What kind of trading setups?: major support and resistance levels trading setup, trendline trading setups, channel trading setups, chart pattern trading setups, like head and shoulders etc.

- Then I move down to the next timeframe, the weekly and do the same. Sometimes, the monthly timeframe covers or hides the trading setups you can see in the weekly.

- Once the weekly timeframe is done, I move down to the next timeframe, the daily, then the 4hr and then the 1hr looking for trading setups.

What you will notice is those larger timeframes like the monthly, weekly and daily will hide or cover trading setups that are happening in the 4hr and the weekly.

But the opposite is also true: if you are focused only on the smaller timeframe trading setups, you will not see the trading setups that are forming in the larger timeframes like the monthly, weekly and daily. So top down technical analysis main purpose, as you can already tell is to identify the trading setups that are forming so you know what is happening and be prepared to trade those setups in the near future.

2. Switch To A Lower Timeframe And Look For The Buy or Sell Trigger (s)

Once you’ve done your top down technical analysis, the next thing is switching down to lower timefames to look for buy and sell signals.

For my case, the lower timeframes I use to execute my trades are:

- 1hr

- 30 min

- 15 min

- 5 minute

- & 1 minute timeframe.

Occasionally I would use the daily and the 4hr timeframe for trade execution. I prefer the 1 hour timeframe most of all.

So what are trigger signals then? Since my multiple timeframe trading is based on price action, my trigger signals to buy and sell are based on candlesticks. More accurately, trigger signals are forex reversal candlestick patterns. These forex reversal candlestick patterns are what I am looking for in the 1hr, 30min,15min,5min & 1 min timeframes to place a buy or a sell trade.

Remember, you are checking all these lower timeframes for the buy and sell signals. Eventually whichever time frame gives the buy and sell signal is the ONLY timeframe you will use to execute a trade.

3. Trade Management

Similarly to using multiple timeframe trading to enter your trades, you can apply the same techniques to manage you trade.

When I talk trade management here, I mean:

- Using trailing stops & locking profits etc

- Taking profit

- Exiting a trade and taking profits when you see condition(s) change based on your multiple timeframe analysis.

So how do you do that? Well, there are few ways you can do that, here are some ideas I’m going to throw out:

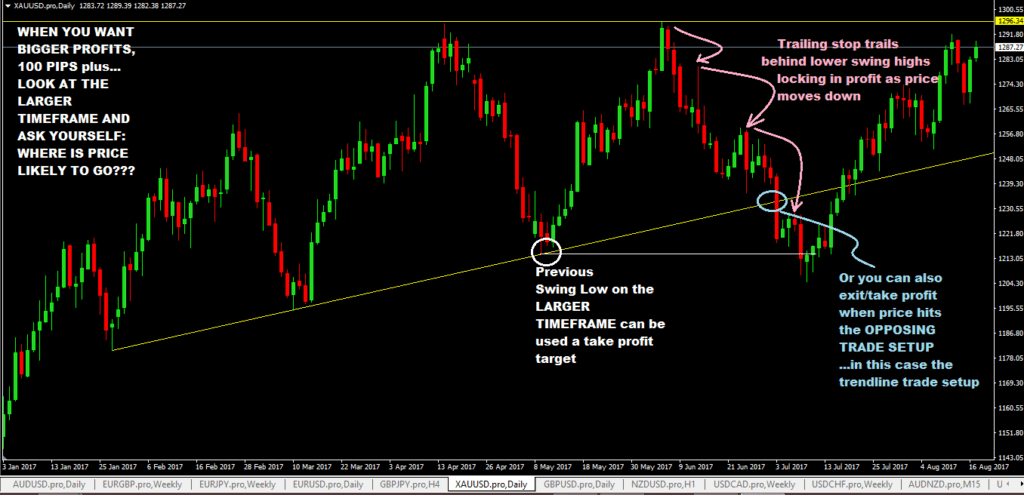

- Use opposite trading setups to exit/take profit

- If the trade setup is based on the larger timeframe, even though you may have traded it in the smaller timeframe, use that larger timeframe for your trade management. This is the case when you are a swing trader aiming for 100 pips plus profit targets.

- If the trade setup is on the larger timeframe, you can also use a much smaller timeframe to manage your trades, like using the lower timeframe swing highs/lows to move your trailing stops to lock in your profits. This is the case when you are a day trader or a short term trader looking that do not like keeping trades on for many days.

Example of A Multiple Timeframe Trading Setup

Here’s an example of how you would actually trade in multiple timeframes: Step 1: Look For Trading Setups In Larger Timeframes (Monthly, Weekly, Daily, 4hr)

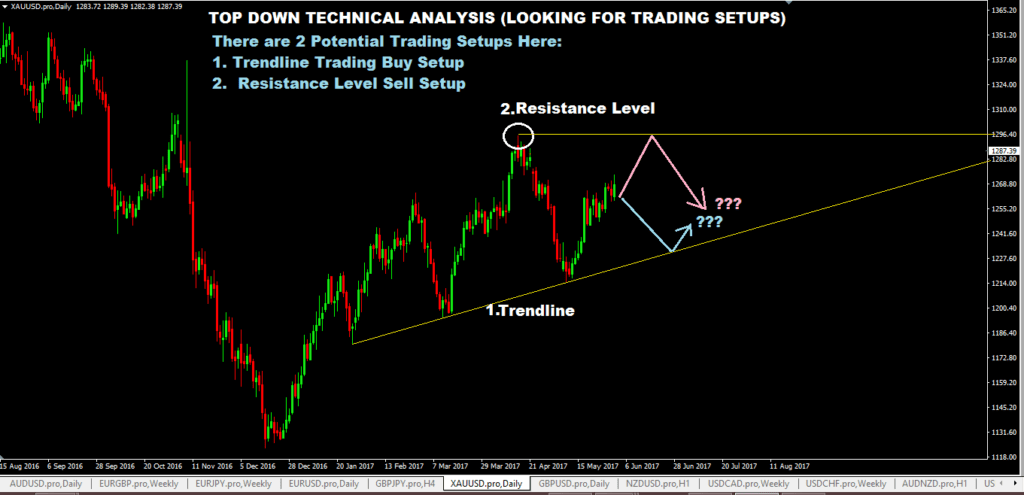

On the daily chart below of XAUUSD, you can see two potential trading setups:

- a sell setup on resistance level

- and a buy trendline trading setup

At this stage, you really don’t know which way price will go and what it will do if it hits any one of these two setups that are identified.

Step 2: Switch To A Lower Timeframe To Look For The Trigger

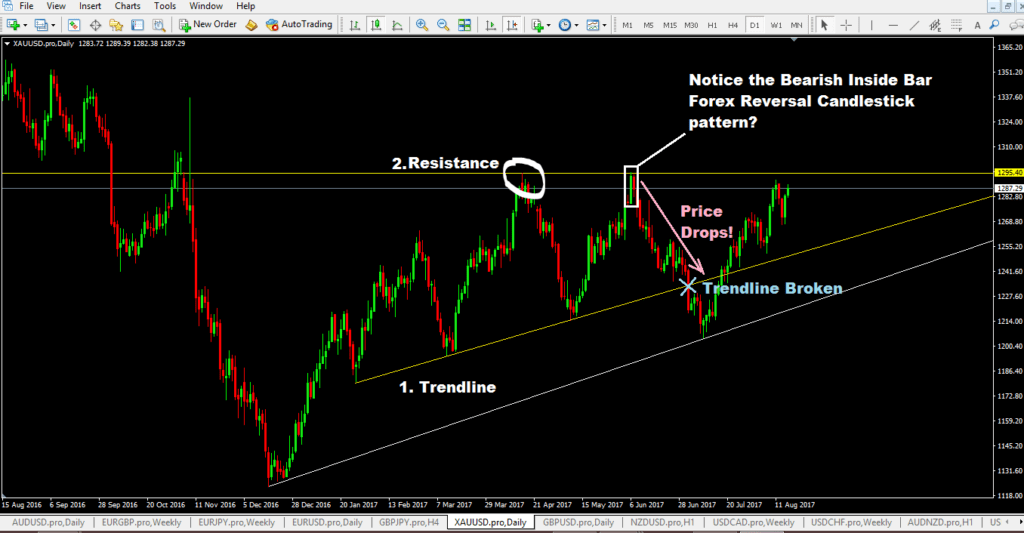

This is the same chart of XAUUSD and as you can see, price has reached the Resistance Level identified in the previous daily chart above. And Bingo!!! You can see a Bearish Pin Bar, formed right there at the resistance level. That was the sell trigger.

All you have to do is place a pending sell stop order at least 2 pips below the low of the bearish pin bar and place your stop loss at least 5-10 pips above the high of bearish pin bar. The formation of the next candlestick would have triggered your pending sell stop order and not you are in a trade.

This is what happened afterwards…

Price dropped a massive 890 pips from the resistance level down to where it started turning back up!

Notice also that on this daily chart below, there was also an bearish inside bar pattern which you could have also traded if you missed the bearish pin bar signal on the 1hr chart.

Step 3: Manage Your Trade

The chart below shows an example of how you can manage a trade from the larger timeframe where the trade setup was identified.

Similarly, you can apply the same techniques on the lower timeframes for take profits/trade exits and trade management.

Advantages of Multiple Timeframe Trading

- if you trade entries are smaller timeframes, that means you stop loss distance size is also small.

- which means you can increase your contract/lot sizes without any additional risk at all.

- which means your risk:reward ratio is really great in comparison to a trader who trades in the same trading setup in a larger timeframe with the same account size and risking the same percentage of trading capital.

- there will be times when you will buy at the very bottom and sell at the very top…almost at the very price level where market starts turning…which means that you immediately start seeing profits piling up in your trade, which also means there’s very less chance of your stop loss getting hit, which means you can actually move your stop loss to breakeven and have a zero risk trade!

- you tend to have a “bigger picture” of what is happening in the larger timeframes, the big trends and where the next big trend may potentially start based on your top down technical analysis…which means that even if you trade a setup based on a lower timeframe setup that goes against the main trend in the larger timeframe, you know when you should be cautions.

Disadvantages Of Multi Time-Frame Trading

- it is a bit of a lengthy process to do the top down technical analysis and may take a while for beginner forex traders to fully grasp.

- switching to lower timeframes for buy or sell means you are getting yourself down to a lot of “noise.” You will need to learn to separate the noise from what is the real buy or sell signal.

- Avoid trading during Asian Forex Trading Session as there can be a lot of noise as well as price does not move as much.

Summary

Don’t believe me…you need to try yourself and see what I’m writing here about multi timeframe trading.

It is important to do your top down technical analysis right to find the trading setups that are forming. The best trading setups are those that are so obvious…they are kinda like prostitutes on the street saying ” Pick me! Pick me!” as you drive by. You can’t miss em…you know what I’m saying?

Now, once you pick em, now its time to get down and dirty…switching back and forth in the smaller timeframes looking for the trigger: a forex reversal candlestick pattern to buy or sell.

The more you do it, the more easier multiple timeframe trading in forex becomes for you.