The piercing line pattern forex trading strategy, as the name says is based on the bullish piercing line pattern, which is a 2 candlestick pattern.

The best way to trade a piercing line pattern is to wait for the pattern to form at levels like:

- Support levels

- Resistance turned support levels

- Fibonacci retracement levels that provide support

- Rising trendline touches/bounces.

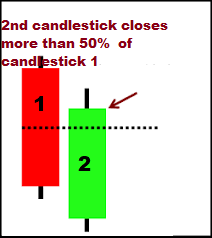

Piercing Line Pattern

What is a piercing line pattern?

- It is a bullish pattern

- The first candlestick is a bearish candlestick followed by a bullish candlestick which closes more than 50% of candlestick 1

Trading Requirements

- Currency pairs: Any

- Timeframe: 5 minutes and above

- Forex Indicators: none required

Buying Rules

- Before you look for a piercing line pattern, the first thing you need to do is identify levels on your charts where the price can find support from and bounce up.

- Then wait for the price to come down and reach those levels and then look for a piercing line pattern to buy.

Here are the buying rules:

- Place a buy stop pending order 1-2 pips above the high of the 2nd candlestick.

- Place stop loss 2-10 pips below the low of the 2nd candlestick

- Take profit: aim for previous swing highs or use risk: reward of 1:3

Advantages

- A very easy pattern to trade

- Simple trading rules

- Potential for 100 pips plus in profit per trade if you trade larger timeframes like the 4hr and the daily

- Use this pattern with other confluence factors like support levels, trendlines, fibonacci retracement levels for more justification for placing your trade.

- You can even use this method as a scalping system.

Disadvantages

- Not all piercing line patterns that form on your chart are tradeable. You need to only pick the best trading setups.

- As mentioned above, the best trading setups are those that happen around price levels where you think the price is going to bounce up, based on several reasons based on your technical analysis.