The resistance turned support forex trading strategy is a price action trading system that is the exact opposite of the support turned resistance forex trading strategy.

So how this this forex system work?

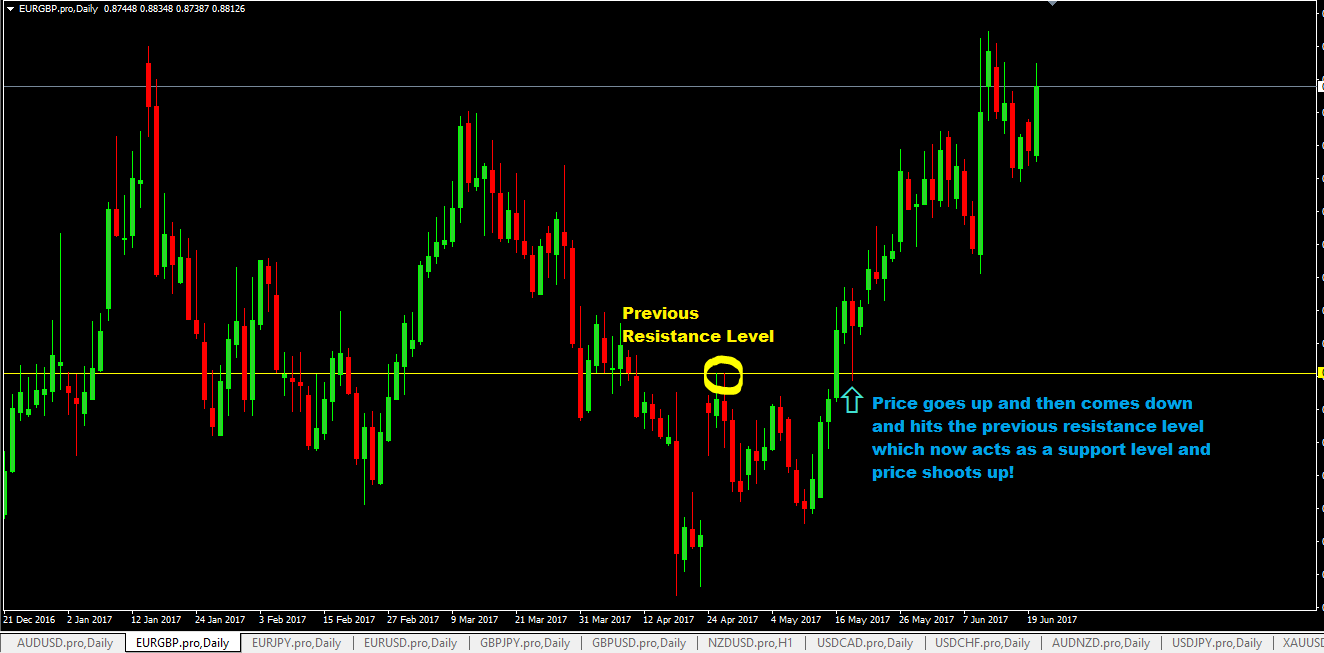

Well, sometimes you will see price head up in an uptrend and break a resistance level. After a while, price will head back down and hit that resistance level that was broken and now that level will act as a support level pushing back price up.

The chart below shows the example of what I am talking about here:

What Currency Pairs Can You Trade With This System?

Any currency pairs can be traded with the resistance turned support forex trading strategy.

What Are The Suitable Trading Timeframes To Trade?

Any timeframes can be traded but I suggest you use 15 minute TF and above.

Any Need For Forex Indicators?

Not required. What you need is just the ability to see bullish reversal candlesticks as these will be your buy signals.

Resistance Turned Support Forex Trading Strategy Rules

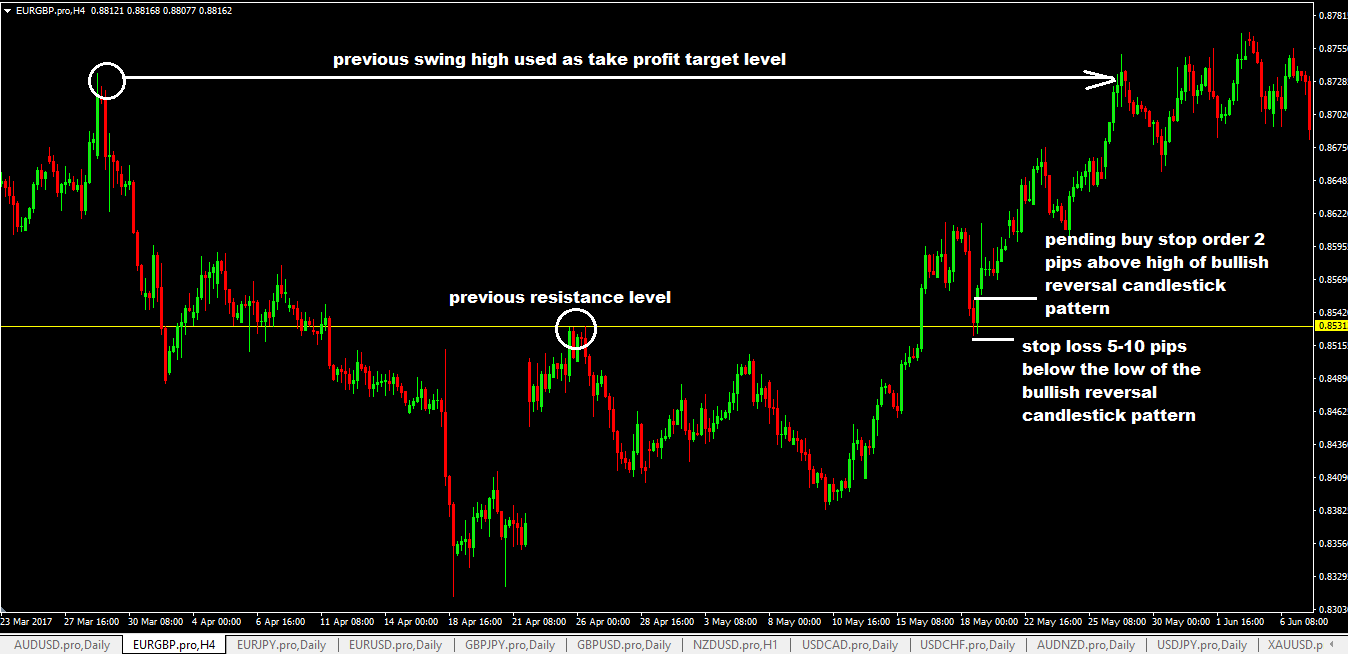

- when price goes down hits the previous resistance level, watch to see if you see bullish reversal candlestick pattern form.

- place a pending buy stop order 2 pips above high of the bullish reversal candlestick pattern.

- place your stop loss 5-10 pips below the low of the bullish reversal candlestick pattern.

- use risk to reward ratio of 1:3 to calculate your take profit of if now, look for a previous swing high level and use that as your take profit target level.

Advantages of The Resistance Turned Support Forex Trading Strategy

- excellent risk:reward for trades that work out as anticipated.

- you see this pattern form in all timeframes quite frequently thus presenting a lot of opportunities to trade.

- simple trading rules

Disadvantages Of The Resistance Turned Support Forex Trading Strategy

- price spikes and whipsawys can happen on the “buying zone” and sometimes these can knock out your stop loss. Such is the nature of forex trading so if your stop loss is a bit too close, consider increasing its size.