The simple moving average cross over forex trading strategy is the most simplest of all forex trading strategies.

What you need is two simple moving average indicators, a faster one and a slower one.

When the faster simple moving average crosses the slower moving average and goes up, then you buy.

If the faster simple moving average crosses the slower simple moving averages and goes down, then you buy.

Moving average trading systems need good trending market for them to work effectively. If you encounter sideways ranging market, you are going to have false signals.

Trading Timeframe

- 15 minutes and upwards

Currency Pairs

- Any currency pair that has strong trending characteristics but preferably the majors

Forex Indicators

- simple moving average in combinations like 7 & 14, 5 & 10, etc.

Trade Setup Example

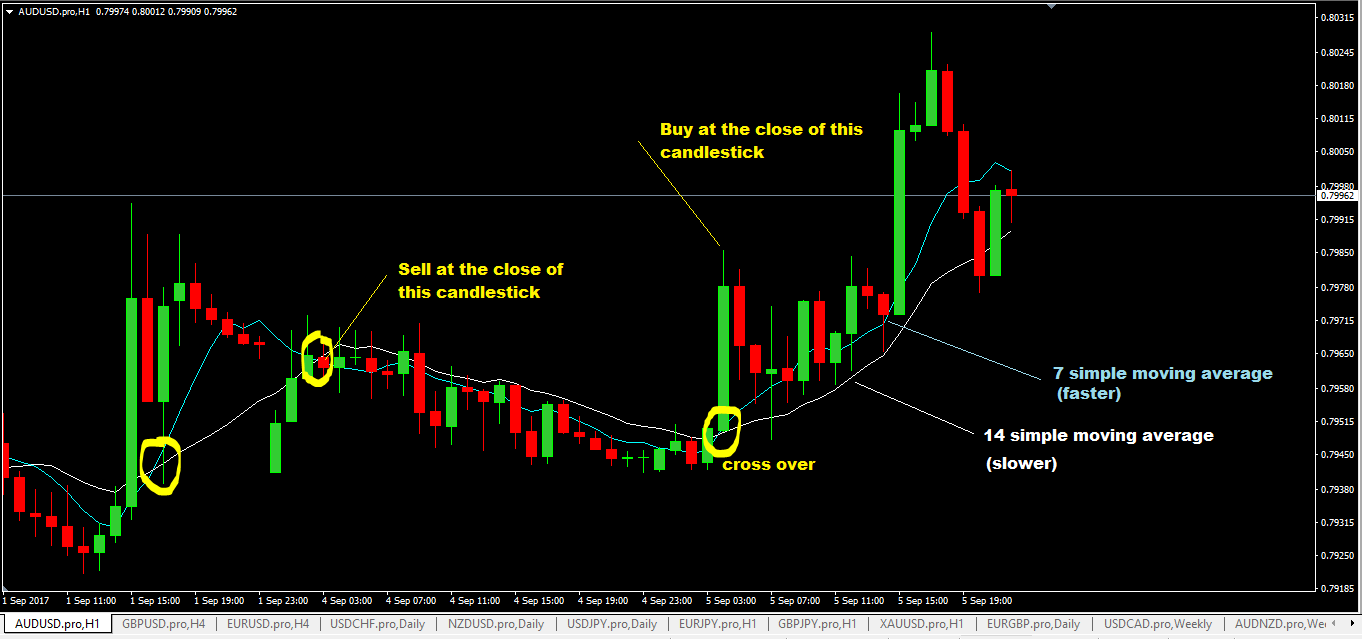

For example, on this chart below, you can see that I have attached a 7 simple moving average with a 14 simple moving average on a AUDUSD 1 hr chart.

Buying Rules

- wait for the faster moving simple moving average to cross the slower one and go up.

- when you can actually see that there is a crossover, then buy at the close of the candlestick that caused the crossover.

- put your stop loss ideally below a technical level to avoid getting stopped out prematurely.

- aim for take profit level that should be 3 times what you risked.

Selling Rules

- when the faster moving average crosses the slower moving average and heads down, sell at the close of the candlestick that causes the cross over.

- again, place you stop loss above a technical level.

- use risk:reward of 1:3 to calculate your take profit target level.

Advantages of the Simple Moving Average Crossover forex Trading Strategy

- very easy to understand and implement.

- works very well in strong trending markets, potential to make hundreds of pips easily with this method.

Disadvantages of the Simple Moving Average Crossover Forex Trading Strategy

- it is a very terrible forex system to use in a flat or non-trending market. You will have lots of loses.

- a simple moving average is a lagging indicator. Price moves far ahead before the indicator responds and follows it and so, every trade your place is effectively a “late” trade.